Advertisement|Remove ads.

DraftKings Stock Rises On Raised Outlook Despite Q4 Earnings Miss: Retail Predicts Growth

Shares of DraftKings ($DKNG) were up more than 5% in after-hours trading on Thursday despite an fourth-quarter earnings miss, lifting retail sentiment to 'extremely bullish' about the company's raised guidance.

DraftKings reported a Q4 loss per share of $0.28, compared to a loss per share of $0.17 expected by Wall Street analysts. While its revenue stood at $1.39 billion, missing estimates of $1.4 billion, according to Stocktwits data.

Its monthly unique payers increased to 4.8 million average monthly customers in the fourth quarter, a 36% jump compared to the year-ago period, said the company. The increase showed strong unique player acquisition and retention across DraftKings’ Sportsbook and iGaming products, it added.

“We continued to efficiently acquire and engage customers, expand structural sportsbook hold percentage and optimize promotional reinvestment in fiscal year 2024, while we simultaneously experienced customer-friendly sport outcomes,” said Jason Robins, DraftKings’ CEO. “Our focus remains on driving sustainable growth in revenue and profitability.”

DraftKings has increased the midpoint of its fiscal year 2025 revenue guidance, predicting revenue in the range of $6.3 billion to $6.6 billion, compared to its previous guidance of $6.2 billion to $6.6 billion.

It also reaffirmed its fiscal year 2025 adjusted earnings before interest taxes, depreciation, and amortization (Ebitda) guidance of $900 million to $1.0 billion.

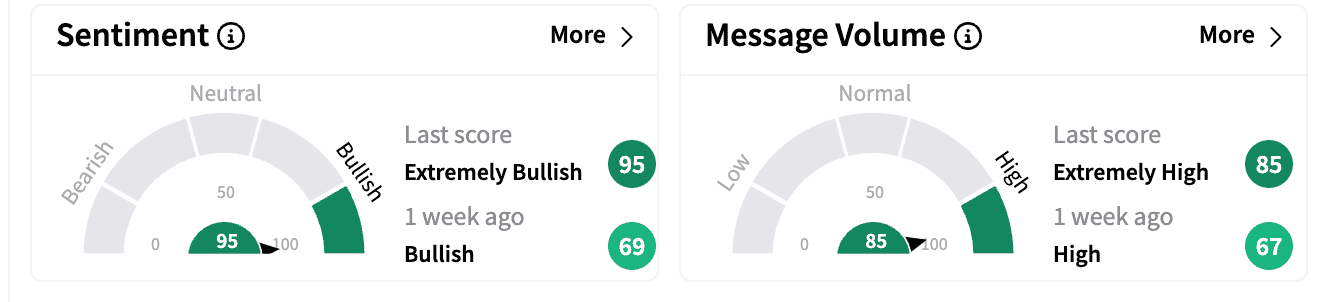

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘bullish’ a week ago. Message volumes climbed to the ‘extremely high’ territory from ‘high.’

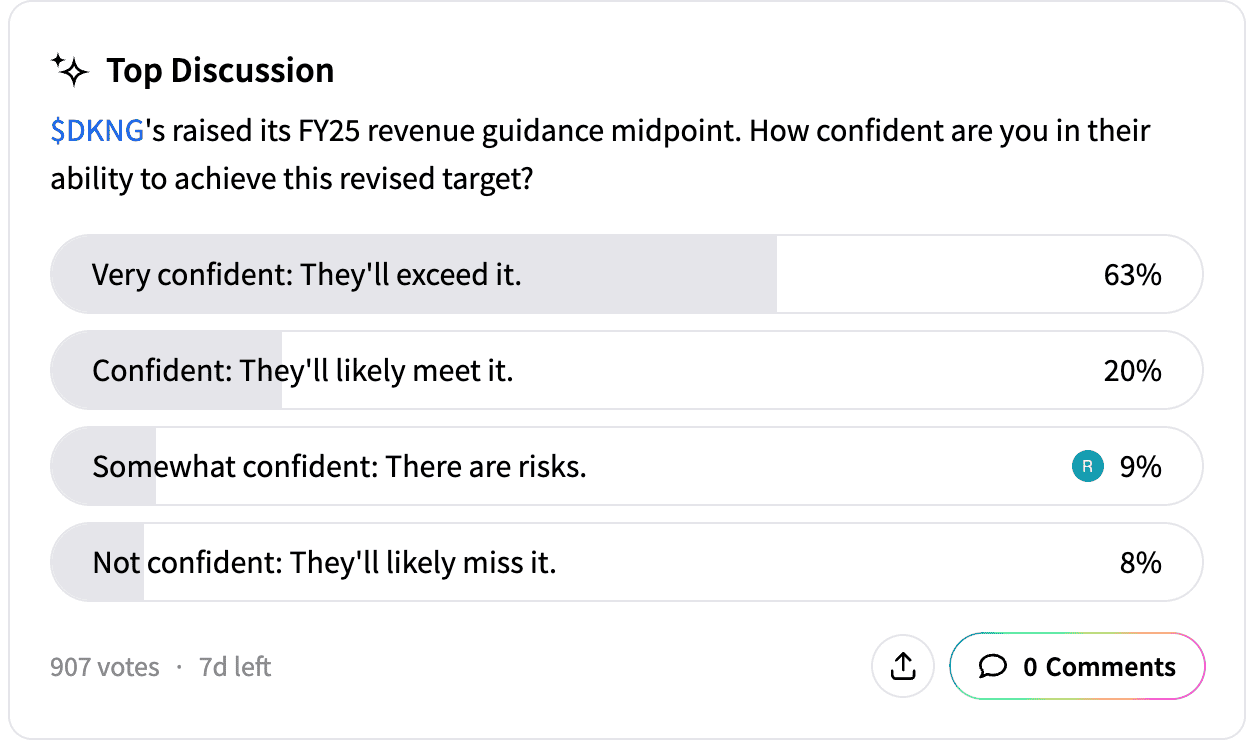

A poll on Stocktwits asked users about their view on the ability of DraftKings to achieve their revenue guidance. A majority (63%) were confident that the company would meet the revised target and may in fact also exceed it. Only about 9% predicted risks.

DraftKings is a digital sports entertainment and gaming company focused on products across daily fantasy, regulated gaming, and digital media.

DraftKings stock is up 15.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)