Advertisement|Remove ads.

Duke Energy’s 2025 Growth Projections Draw Jefferies Price Hike Despite Q4 Weakness

Duke Energy (DUK) shares held steady in pre-market trade on Friday after Jefferies raised its price target on the stock, which implies a 17% upside from current levels.

The brokerage hiked its price target on Duke Energy shares to $132 from $129 while reiterating a ‘Buy’ rating. It attributes its bullish outlook to the utility’s forward-looking guidance for 2025.

Last week, Duke reported fourth-quarter earnings per share (EPS) of $1.66, aligning with Wall Street estimates of $1.65, according to Stocktwits data. However, revenue came in at $7.36 billion, missing analysts’ expectations of $7.58 billion.

The company expects adjusted EPS in 2025 to range between $6.17 and $6.42, with a midpoint of $6.30.

According to Jefferies, the 5.4% year-over-year growth from the original midpoint of its 2024 guidance is a positive indicator.

Analysts also noted that management revised its guidance language, now focusing on the upper half of its previously stated 5% to 7% EPS compound annual growth rate (CAGR) through 2029 rather than aiming solely for the top end.

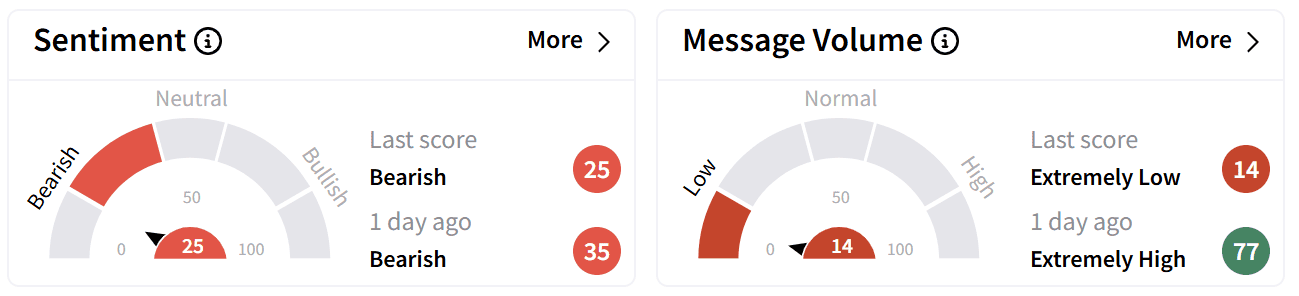

On Stocktwits, retail sentiment dipped further into the ‘bearish’ zone as chatter plummeted to ‘extremely low’ levels.

Duke Energy’s shares have gained 4% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)