Advertisement|Remove ads.

Akamai Plunges Pre-Market After Analysts Downgrade Stock On Weak 2025 Outlook – Retail’s Disappointed

Akamai Technologies Inc. (AKAM) tumbled more than 12% in premarket trading on Friday after the company’s first-quarter and full-year 2025 guidance fell short of Wall Street expectations, prompting multiple analyst downgrades.

If losses hold, the stock is set to hit a three-month low.

The content delivery network and security solutions provider beat earnings estimates and posted in-line revenue for the fourth-quarter (Q4).

Earnings per share (EPS) came in at $1.66, ahead of the estimated $1.52, on revenue of $1.02 billion.

Akamai expects first-quarter earnings per share (EPS) to be between $1.54 and $1.59, which is below the consensus estimate of $1.66. Revenue guidance for the quarter came in between $1 billion and $1.02 billion, missing Wall Street’s expectation of $1.04 billion.

For the full fiscal year, the company forecast EPS between $6 and $6.40, compared to an estimated $6.82. It expects revenue in the range of $4 billion to $4.2 billion, falling short of analysts’ consensus of $4.26 billion.

The weaker outlook led Piper Sandler to downgrade Akamai to ‘Neutral’ from ‘Overweight’ and cut its price target to $100 from $112, according to TheFly.

The brokerage noted that Akamai’s guidance was even lower than anticipated and flagged concerns over slowing growth, declining margins, increased capital expenditures, and revenue substitution risks.

Piper Sandler also questioned whether Akamai’s fastest-growing segments could meaningfully offset weaknesses in its core business, stating investors "should look elsewhere until some of the dust settles."

TD Cowen also downgraded the stock to ‘Hold’ from ‘Buy’ and slashed its price target to $98 from $125.

The brokerage cited a reduction in long-term revenue growth guidance across all segments, a weaker margin outlook, and higher capital expenditure expectations.

TD Cowen also expressed skepticism about Akamai’s ability to compete effectively in the cloud market, calling the company’s strategic shift a “greater degree of execution risk.”

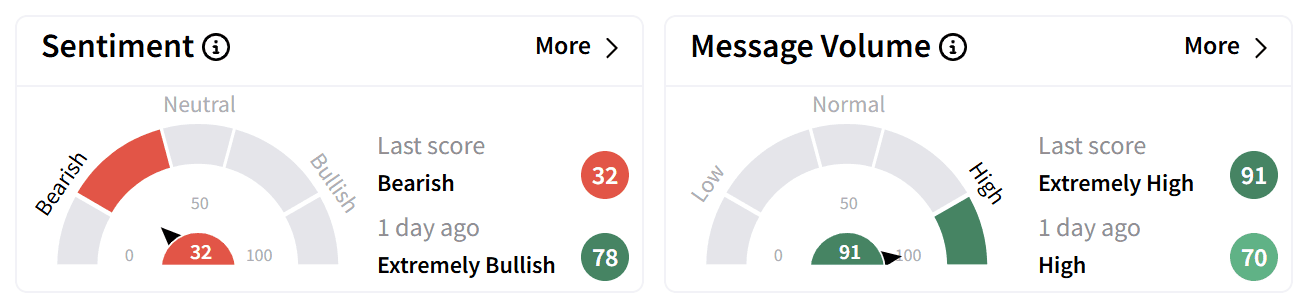

On Stocktwits, retail sentiment around Akamai deteriorated to ‘bearish’ (32/100) from ‘extremely bullish’ a day ago, as chatter increased to ‘extremely high’ levels.

Some users predicted a significant selloff when markets opened, while others suggested that the company should cut costs to improve profitability.

Akamai’s stock has struggled over the past year, declining more than 9%, but it remains up roughly 1% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Southern Company Stock Gains As Q4 Revenue Tops Estimates, Retail Investors Remain Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)