Advertisement|Remove ads.

Earnings Preview: AMD, Microsoft, PayPal, Starbucks, SoFi Technologies

Several of Wall Street’s biggest tech names are reporting their quarterly earnings this week. However, the market’s rotation out of mega caps into small caps and post-earnings declines in Tesla and Alphabet have led to caution among retail investors. Of the five heavily-followed firms scheduled to report their quarterly earnings on Tuesday, not one is exhibiting bullish sentiment on Stocktwits.

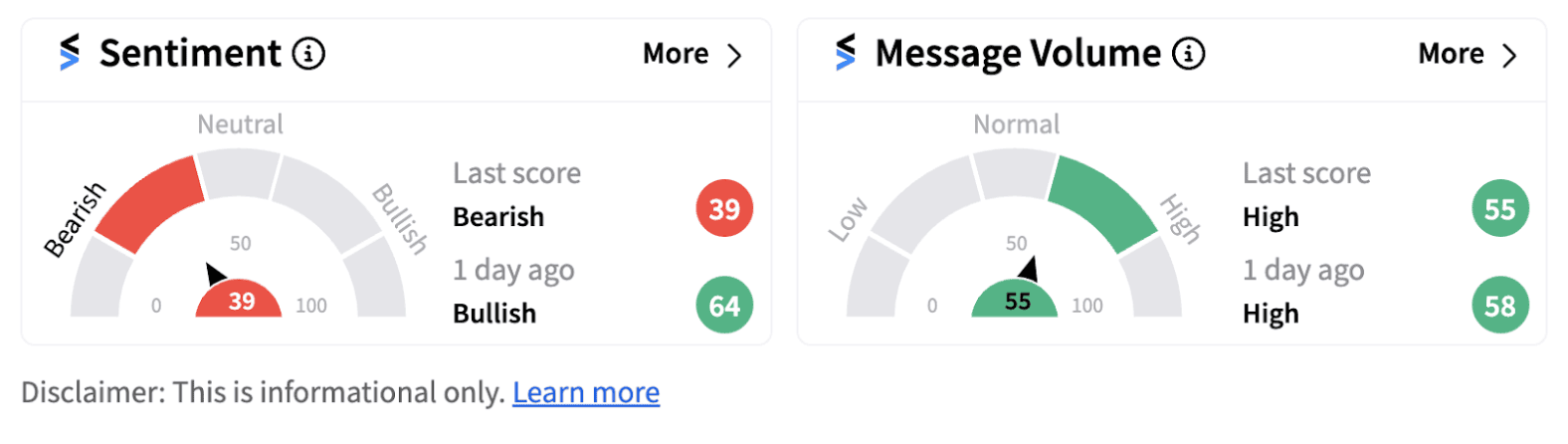

1. AMD: The Street expects the firm to report revenue of $5.72 billion and adjusted earnings per share (EPS) of $0.68 after-hours on Tuesday. The estimates suggest a rise in these metrics compared to a year ago, but retail sentiment is trending in bearish territory (39/100). The bearish sentiment indicates caution ahead of the earnings report, with investors awaiting the company’s artificial intelligence (AI) revenue and related guidance. Moreover, the planned retirement of the firm’s President Victor Peng at the end of August 2024 is something investors are awaiting more clarity on.

2. Microsoft: Retail sentiment has been stuck in bearish territory (41/100) for the last week as investors prepare for the company’s fourth-quarter earnings after the bell on Tuesday. Revenue is expected to come in at $64.41 billion while EPS is projected at $2.94, according to a Street estimate. While Wall Street’s projections remain upbeat, retail investors are maintaining a cautious approach given the unknown impact of its global systems outage and the market’s recent rotation away from the magnificent seven stocks.

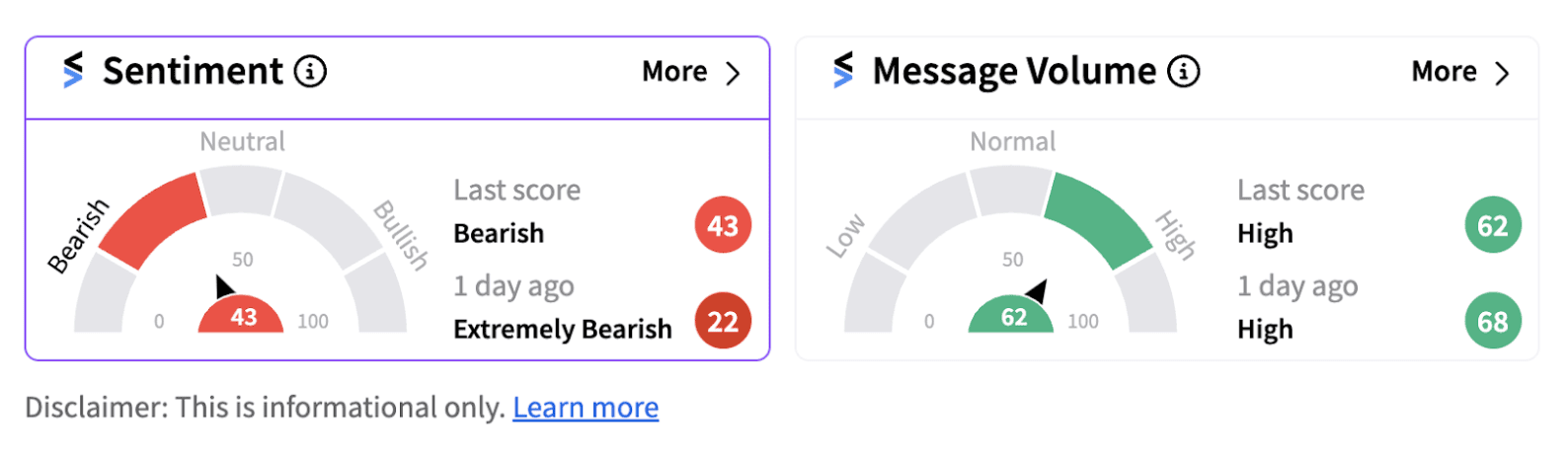

3. PayPal: The payments giant is expected to report a year-over-year (YoY) decline in EPS at $0.96 while revenue is expected to rise to $7.78 billion. Retail sentiment has improved from extremely bearish territory to bearish (43/100) in early trading, but has not entered bullish territory since July 22. The firm is in the midst of a restructuring plan that included thousands of job cuts. Investors will be closely analyzing whether these cuts were enough to buoy margins and bottom-line profits when PayPal reports Tuesday before the bell.

4. Starbucks Corp: The coffee chain is expected to post EPS of $0.93 per share on revenue of $9.22 billion when it reports earnings Tuesday after market close. Retail sentiment is trending in bearish territory (42/100) ahead of the report, with investors on Stocktwits concerned about the ongoing battle between management and activist investor Elliott Management. Recently Elliott has built a sizable stake to enact change at the company. However, former CEO and sixth largest shareholder, Howard Schultz, is actively opposing the deal, according to an FT report.

5. SoFi Technologies Inc: The popular neobank is expected to report a YoY decline in revenue at $564.39 million and earnings per share of $0.01 when it reports before the bell on Tuesday. Earlier this month, a Seaport Research analyst reportedly said that some quarter-over-quarter headwinds might impact the firm’s short-term results. Retail investors remain cautious ahead of the results, with Stocktwits sentiment falling daily since July 12 and currently sitting in the bearish zone (39/100).

Photo Courtesy: Athar Khan on Unsplash

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1289252849_jpg_5041bcf62e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/02/paypal2.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_Jensen_Huang_jpg_c64c858674.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_johnson_johnson_logo_resized_eaf5f62dff.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)