Advertisement|Remove ads.

Eaton Corp Stock Rises On Acquisition Of Fibrebond Corporation For $1.4B: Retail’s Not Impressed Yet

Power management company Eaton Corporation (ETN) shares traded over 1% higher in Tuesday’s pre-market session after the firm announced it has agreed to acquire Fibrebond Corporation for $1.4 billion.

Fibrebond Corporation designs and builds pre-integrated modular power enclosures for data center, industrial, utility, and communications customers. For the 12 months ending Feb. 28, 2025, the company projects revenues of approximately $378 million.

Eaton said the acquisition will generate $110 million of estimated 2025 adjusted earnings before interest, tax, depreciation, and amortization (EBITDA).

The deal, which is expected to be neutral from an earnings-per-share standpoint in 2025, will likely close in the third quarter of 2025.

Mike Yelton, president of the Americas Region, Electrical Sector at Eaton, said Fibrebond is known for its engineering capabilities and customer focus, including in the multi-tenant data center market.

“Its engineered-to-order power enclosures, in which equipment installation and testing procedures are performed off-site, enables customers to get up-and-running in less time and at a lower cost. This full-service offering allows us to better serve our customers amid accelerating demand,” he said.

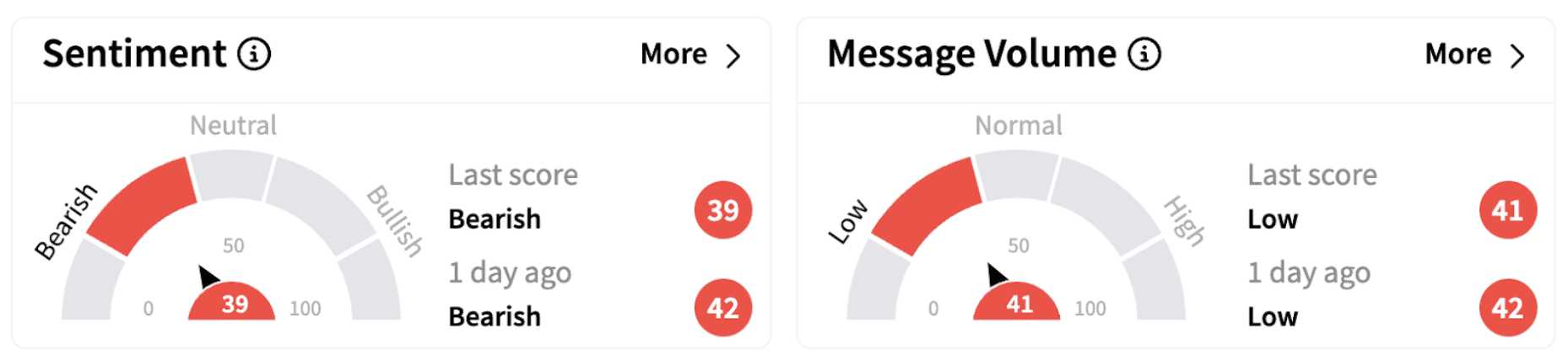

Despite the report, retail sentiment on Stocktwits dipped further into the ‘bearish’ territory (39/100).

Recently, RBC Capital lowered its price target on Eaton to $376 from $405 while keeping an ‘Outperform’ rating on the shares, according to TheFly.

Wells Fargo analyst Joseph O'Dea also lowered the firm's price target on Eaton to $305 from $335 while keeping an ‘Equal Weight’ rating on the shares.

Eaton shares have lost over 16% in 2025 and are down over 5% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)