Advertisement|Remove ads.

FedEx CFO John Dietrich Says Shipping Giant Equipped To Adapt To Incoming Trump Administration’s Tariffs

Donald Trump’s victory in the 2024 presidential election has raised the specter of higher tariffs, which have the potential to fan inflationary pressures. Shipping giant FedEx, Inc.’s ($FDX) CFO John Dietrich on Tuesday weighed in on how Trump’s tariffs could impact the company’s businesses.

At the Baird Global Industrial Conference, Dietrich was asked about the net impact of tariffs, taxes, and deregulation, as well as the implications of the election results for FedEx’s business.

Dietrich emphasized that FedEx is a global player, operating internationally and having an adaptable business model. He said the company does business in 220 countries, and it can adapt to wherever the demand is generated.

The executive said China will continue to be a producer. “If the demand and the volumes go elsewhere, we're well equipped to adapt to that, and we're watching it very closely,” he said.

“We do support free trade,” he said. All the same, he expressed willingness to work with the administration.

Dietrich said FedEx is looking to promote the interest of its business in Washington, D.C. “We have some very good relationships in Washington and spend a lot of time there making sure that our interest in our business is heard,” he added.

Tariffs are a tax levied on imported goods to promote domestic competitiveness. Trump has proposed new tariffs in the range of 10%-20% on all imports, with the rates increasing to 60% for Chinese imports. He also proposes a levy of 25%-100% on Mexican imports.

LPL Chief Economist Jeffrey Roach said in a recent note to clients that tariffs typically create a deadweight loss to the economy. He warned of negative impact on businesses and consumers, shrinkage of the job market, and potential retaliation from trading partners.

The Tax Foundation recently said, “Tariffs will certainly create benefits for protected industries, but those benefits come at the expense of consumers and other industries throughout the economy.”

FedEx’s first-quarter results released in late September showed sub-par revenue and earnings performances, dragged by the economic uncertainties. The company also lowered its revenue growth guidance for the full year.

FedEx shares have gained 17.32% for the year-to-date period. As of 3:23 pm ET, the stock was rising 1.72% to $292.20.

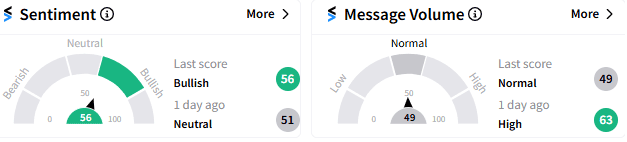

Sentiment toward the stock was "bullish" (56/100) on Stocktwits' sentiment meter, accompanied by "normal" message volume.

Read Next: Cisco Analysts Brace For Q1 Beat As Spending Environment Improves: Retail Mood Buoyant

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)