Advertisement|Remove ads.

Elon Musk Says It Was 'Difficult' Path To Tesla's $28B Q3 Revenue, Blasts ‘Absurd’ Proxy Firms As Shareholder Pay Vote Nears

- Musk said it was “difficult building this revenue,” replying to a post showing Tesla’s decade-long sales climb from $852 million in 2014 to $28.1 billion in 2025.

- He renewed calls for proxy advisors ISS and Glass Lewis to register as investment advisers, saying their influence over passive index funds often leads to votes “unrelated to shareholder interests.”

- Musk criticized both firms for recommending votes against directors Ira Ehrenpreis and Kathleen Wilson-Thompson, as investors prepare for the Nov. 6 vote on his proposed $1 trillion compensation plan.

Tesla, Inc. CEO Elon Musk described the company’s path to its record $28.1 billion third-quarter revenue as “difficult” and renewed criticism of shareholder advisory firms ISS and Glass Lewis ahead of a key vote on his multibillion-dollar pay package next month.

‘Difficult Building This Revenue’

Responding to a post by financial commentator Jon Erlichman outlining Tesla’s revenue growth over the past decade, from $852 million in 2014 to $28.1 billion in 2025, Musk replied on X, “It was difficult building this revenue.”

Criticism Of Proxy Advisors

In a separate post, Musk endorsed a post from Grok calling for tighter regulation of proxy advisory firms. He wrote that “shareholder advisory firms need to register as investment advisors,” adding that “the absurdity, arguably illegality, of them not doing so is obvious in the description.”

Musk expanded on his criticism, arguing that roughly half of all publicly traded shares are controlled by passive index funds that outsource their voting decisions to ISS and Glass Lewis. He said these firms often “vote along random political lines unrelated to shareholder interests.”

Citing Tesla’s upcoming shareholder meeting on Nov. 6, Musk said the advisory firms had recommended voting against one of Tesla’s long-serving directors, Ira Ehrenpreis, for “insufficient gender diversity,” while also opposing the re-election of Kathleen Wilson-Thompson.

Pay Vote Looms

The comments come as Tesla investors prepare to vote on Musk’s proposed $1 trillion pay package, which analysts have backed as essential to maintaining his leadership during an essential phase for the company’s artificial intelligence, robotics, and self-driving initiatives.

Tesla shares fell about 4% in extended trading on Wednesday after the company’s quarterly profit missed expectations despite record deliveries and revenue growth.

What’s The Mood On Stocktwits?

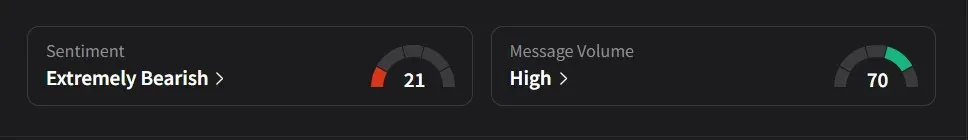

On Stocktwits, retail sentiment was ‘extremely bearish’ amid ‘high’ message volume.

Tesla’s stock has risen 9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)