Advertisement|Remove ads.

Energy Fuels Stock’s Retail Chatter Heats Up As Congressional Visit Raises Speculation Of US Deal

Energy Fuels (UUUU) stock drew retail buzz on Tuesday after rising over 7% in the regular trading session.

The stock continued its gain and was up 4.1% in extended trading. The stock was among the top five trending tickers at the time of writing, according to Stocktwits, and has gained 7.7% more followers over the past 30 days.

An interest in the stock sparked as a U.S. Congressional delegation visited the company’s processing facility in White Mesa, Utah, the only conventional operating uranium mill in the U.S. The visitors included Colorado representative Jeff Hurd, a member of the Science Subcommittee on Energy, as well as Utah Congressmen Burgess Owens and Mike Kennedy,

“This facility doesn’t just produce uranium: it’s the only producer of dysprosium oxide in the Western Hemisphere, a rare earth element for advanced military and energy technologies. It’s also a model for what responsible critical mineral development can look like,” Hurds said in a post on X.

The Trump administration has identified uranium energy as the key to meeting the rapidly spiking electricity demand in the U.S. The Trump administration is seeking to reduce its reliance on Russia, which supplies about a quarter of the enriched uranium used to generate about 20% of the total U.S. electricity.

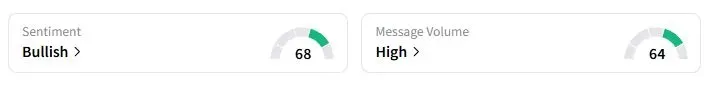

Retail sentiment on Stocktwits about Energy Fuels was in the ‘bullish’ territory at the time of writing, while retail chatter was ‘high.’

The company is also pushing into rare earths, as the U.S. relies heavily on China for the minerals used in everything from missiles to renewable energy. Last month, Energy Fuels agreed to supply initial quantities of high-purity "light" and "heavy" separated rare earth oxides to Vulcan Element in the fourth quarter, to validate them for the production of rare earth magnet applications.

“[It] can only mean one thing, [a] government contract coming our way. Lookout gang, here we go,” one Stocktwits user said.

“I [am] thinking it’s the Silence before the Storm! Double coming soon!” another user said.

Energy Fuels stock has more than tripled this year. The U.S. government has already acquired stakes in companies such as Intel and MP Materials, which it deems are key to national security.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)