Advertisement|Remove ads.

Bitcoin, Ether, XRP Slip After Fed’s Powell Flags ‘Challenging Situation Ahead’ — Some Retail Traders Looking To ‘Buy The Dip’

Major cryptocurrencies edged lower in early trading on Wednesday, after Federal Reserve Chair Jerome Powell hinted that the U.S. central bank could take a hawkish approach to interest rate cuts.

Bitcoin prices were down 0.2% at $112,707, Ethereum was down 0.7% at $4,175.78, and XRP fell 0.8% to $2.85, according to Coingecko data. Among other tokens, Solana was down 4.4% and Dogecoin was down 1.6%.

“Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation. Two-sided risks mean that there is no risk-free path,” Powell said in a speech on Tuesday.

He also stated that while the Fed’s current monetary policy is “moderately restrictive,” it leaves the central bank with the option to respond to economic developments and steer the policy as needed. Last week, the Fed cut the key borrowing rate by 25 basis points, bringing down the federal funds rate to the 4% to 4.25% range, in line with market expectations.

According to SoSoValue data, Bitcoin spot ETFs logged an outflow of $103.6 million, while Ether ETFs saw net outflows of $140.75 million. The total market capitalization of cryptocurrencies fell to $3.98 trillion. “Powell’s speech and a cheeky 25bps (basis points) rate cut have traders twitchy,” said BTC Markets analyst Rachael Lucas.

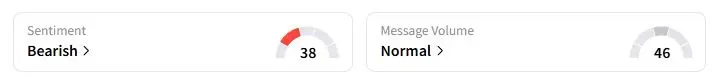

Still, retail sentiment on Stocktwits about Bitcoin was in the ‘bearish’ territory at the time of writing.

However, according to the data tracking platform Santiment, mentions of "buy the dip" have risen to their highest level in a month, suggesting that some retail traders may view the recent dip in the apex cryptocurrency’s prices as an opportunity.

“Prices typically move [in] the opposite direction of the crowd's expectations,” noted Santiment analysts. “So if retail traders believe that $112.2k is finally the time to buy, then a little more pain needs to be felt. Once the crowd stops feeling optimistic, and they begin to sell their bags at a loss, this is typically the time to strike with your dip buys.”

In other significant developments in the crypto world, a report said that Tether is planning to raise between $15 billion and $20 billion in exchange for a roughly 3% stake through a private placement. If it achieves the top end of its target, its valuation may soar to $500 billion, placing it in the same league as OpenAI and SpaceX.

The U.S. Commodity Futures Trading Commission is also launching an initiative to permit stablecoins as tokenized collateral, amid the Trump administration’s push for cryptocurrencies.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Big_Bear_jpg_8fce0f24aa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1242030871_jpg_12741b089b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)