Advertisement|Remove ads.

Energy Transfer Rises After Higher Q1 Profit, Co-CEO Says Well Positioned To Manage Oil Production Decline: Retail’s Extremely Bullish

Energy Transfer (ET) stock rose 1.5% in extended trading on Tuesday after the company reported an uptick in first-quarter earnings.

The company reported net income attributable to partners of $1.32 billion for the three months ended March 31, compared to $1.24 billion a year earlier.

Its first-quarter revenue of $21.02 billion missed Wall Street’s expectations of $21.54 billion.

The company said its crude oil transportation volumes rose 10%, aided by higher volumes in the Permian Basin, which were up 8%, and the addition of the WTG assets in July.

U.S. oil production has reached record levels, aided by advancements in fracking technology and efficiency gains.

The company said its interstate natural gas transportation volumes were up 3% and set a new record.

Its natural gas liquids (NGL) transportation volumes were up 4%, and NGL and refined products terminal volumes were up 4%.

The company reiterated its 2025 adjusted earnings before interest, taxes, depreciation, and amortization forecast between $16.1 billion and $16.5 billion.

While some Permian-based oil and gas firms have said they would lower oil drilling activity amid a low price environment, Energy Transfer said it was well-positioned to manage the situation as it expects natural gas and NGL demand to grow.

The company also said it could announce partnerships related to artificial intelligence data centers in the coming weeks.

“We feel like we're sitting on a gold mine,” Co-CEO Marshall McCrea said.

In April, the company signed a non-binding deal with Midocean Energy to develop the Lake Charles liquefied natural gas project in Louisiana.

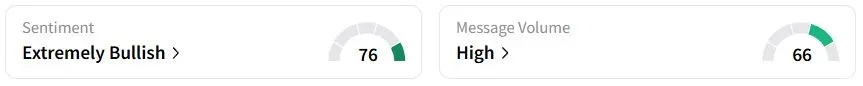

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (76/100) territory, while retail chatter was ‘high.’

One user spoke about the rising number of data centers and their energy needs.

Energy Transfer stock has fallen 19.2% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trip_Advisor_jpg_c5134f02d2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239438284_jpg_9bc3b92eab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_890301280_jpg_3a63f65280.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246906030_jpg_5d1c52da00.webp)