Advertisement|Remove ads.

Enphase Energy Stock Plunges Pre-Market After Q3 Earnings Miss: Retail Sentiment Plummets

Enphase Energy ($ENPH) shares tumbled over 13% in pre-market trading on Wednesday following the release of disappointing third-quarter earnings and weak fourth-quarter guidance.

The company reported Q3 earnings of $45.8 million, or $0.33 per share, down sharply from $113.9 million, or $0.80 per share, a year ago.

Adjusted earnings came in at $0.65 per share, falling short of analysts’ expectations of $0.78.

Revenue also missed estimates, dropping to $380.9 million from $551.1 million a year earlier, while analysts had forecast $393 million.

While U.S. revenue rose 43% quarter-over-quarter due to increased shipments to distributors, Enphase’s European revenue declined 15%, reflecting softening demand in the region.

For Q4, the company issued revenue guidance of $360 million to $400 million, well below the $435.84 million consensus.

Gross margins are expected to remain strong at 49% to 52%, with operating expenses between $81 million and $85 million.

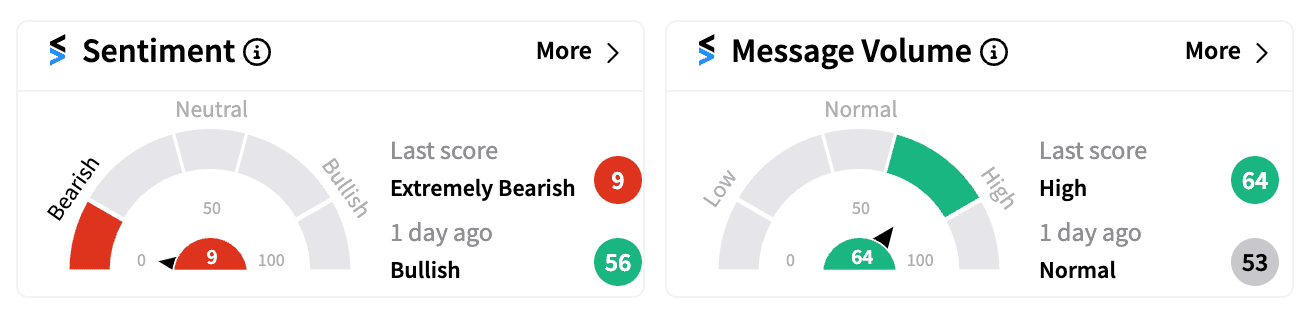

Retail sentiment for Enphase turned sharply negative following the earnings report, with Stocktwits showing an ‘extremely bearish’ score (9/100), the lowest this year, a drastic drop from the previous day’s ‘bullish’ sentiment.

Enphase’s results also dragged down other solar stocks. SolarEdge Technologies ($SEDG) dropped over 5%, First Solar ($FSLR) fell more than 1.5%, and Sunrun ($RUN) lost nearly 2% before the bell.

Guggenheim downgraded Enphase from ‘Neutral’ to ‘Sell’ with a $73 price target, citing the company’s strong U.S. presence but significant challenges in Europe.

The analyst noted growing competition in the energy storage segment from Tesla ($TSLA) but highlighted issues at rival SolarEdge and slow progress from Generac ($GNRC), which leaves room for Enphase to remain competitive in the U.S.

SolarEdge, which reports Q3 earnings on Nov. 6, faces similar headwinds in Europe. JPMorgan lowered its price target for SolarEdge to $29 from $35, cautioning investors about ongoing weakness in the European market.

Year-to-date, Enphase shares have dropped nearly 30%, while SolarEdge is down 80%. Sunrun has fallen 27%, but First Solar has gained 17%, reflecting a more resilient position in the sector.

For updates and corrections email newsroom@stocktwits.com

Read next: McDonald’s Shares Slide Pre-Market After Quarter Pounder E.Coli Outbreak: Retail Confidence Dips

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)