Advertisement|Remove ads.

McDonald’s Shares Slide Pre-Market After Quarter Pounder E.Coli Outbreak: Retail Confidence Dips

Shares of McDonald’s Corp. ($MCD) dropped over 7% pre-market on Wednesday after the CDC linked an E. coli outbreak to the company’s Quarter Pounder hamburgers.

The CDC stated that 49 cases were reported across 10 states, resulting in 10 hospitalizations and 1 death, with most illnesses in Colorado and Nebraska.

McDonald’s said it has proactively pulled slivered onions and Quarter Pounder beef patties in several states while investigations continue to identify the contaminated ingredient.

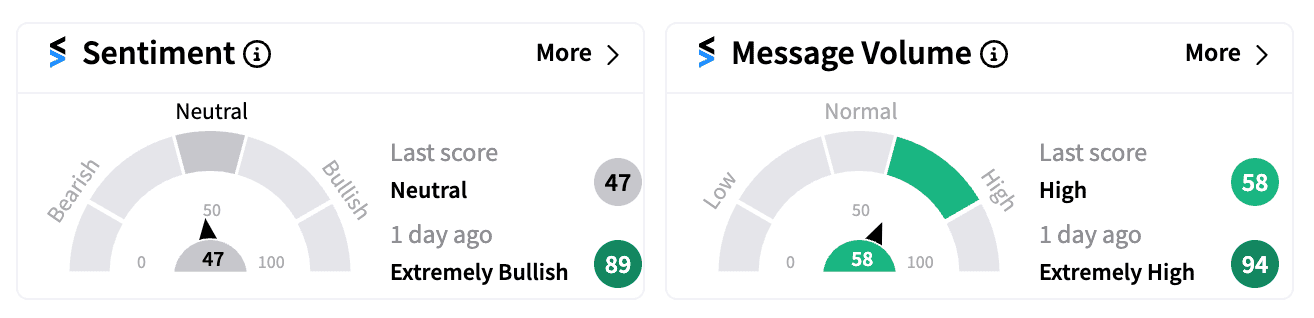

On Stocktwits, retail sentiment turned ‘neutral’ as of 6:30 am ET, down from ‘extremely bullish’ the day prior, amid a spike in message volume.

https://stocktwits.com/BuyHighThenPanic/message/589763443

https://stocktwits.com/NightBreeze/message/589794559

On Wall Street, at least two analysts downgraded the stock following the news.

However, Barclays maintained an ‘Overweight’ rating and $325 price target.

While the near-term impact on consumer confidence and restaurant fundamentals could be significant, history suggests the brand can recover in time, Barclays said.

Bernstein estimated a potential 0.4% impact to Q4 same-store sales following McDonald’s decision to halt Quarter Pounder sales in certain states but acknowledged the brand’s quick response may help minimize damage.

The brokerage compared the situation to Chipotle’s 2015 outbreak, suggesting it could weigh on consumers’ long-term perception of food safety. Bernstein kept a ‘Market Perform’ rating with a $280 price target.

McDonald’s is due to report third-quarter earnings next week, and the stock is up nearly 6% this year, as of last close.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)