Advertisement|Remove ads.

Enviro Infra May Rally Another 20% As SEBI RA Spots Bullish Setup Post ₹395 Cr Order Win

Enviro Infra shares rose 6% intraday on Thursday after securing a ₹395 crore order from Maharashtra Industrial Development Corporation (MIDC). This is in a joint venture with AltoraPro Infrastructure,

The company received a letter of intent (LoI) on July 8 to upgrade treatment plants in Kolhapur district as part of the Panchganga River pollution control programme. The project is to be completed in the next 24 months.

SEBI-registered analyst Varunkumar Patel highlighted that this project win adds to the company’s robust ₹2200 crore order book. It had also recently won multiple sewage treatment plant (STP) contracts in Chhattisgarh, worth ₹306 crore.

The company is strengthening its dominance in industrial wastewater and green infrastructure.

On the technical charts, Patel noted that its Relative Strength Index (RSI) stands at around 60, indicating bullishness. He identified support near ₹225–230 and resistance around ₹270 for momentum play for Enviro Infra.

Patel also highlighted the following triggers to watch for in the stock, which include order execution and timely billing to boost revenue and cash flow, as well as any follow-up orders.

He sees the potential for a technical breakout above resistance, and the stock could likely target ₹300 next.

Enviro Infra was founded in 2009 and listed on the exchanges in November 2024.

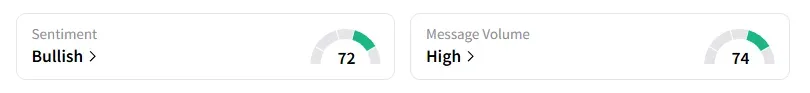

Data on Stocktwits shows retail sentiment turned ‘bullish’ a day ago on this counter amid ‘high’ message volumes.

The stock has fallen 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)