Advertisement|Remove ads.

Eos Energy Receives Final $40.5M Of Delayed Draw Term Loan After Hitting Key Milestones: Retail’s Elated

Shares of Eos Energy Enterprises Inc (EOSE) were in the spotlight on Monday after the company announced it had received access to the final $40.5 million of the Delayed Draw Term Loan (DDTL) after having met the third set of performance milestones agreed upon between the firm and an affiliate of Cerberus Capital Management.

Eos said that the $210.5 million DDTL announced in June 2024 is now fully funded after having met operational milestones related to its state-of-the-art manufacturing line, raw materials cost-out, Z3 technology performance improvement, and orders backlog cash conversion.

Eos said it surpassed its January raw materials cost-out target by 6% while delivering manufacturing cycle times below 10 seconds.

Cerberus Senior Managing Director Nick Robinson said 2025 and beyond is all about revenue growth, profitability, and acceleration of global manufacturing capacity to meet exponential global demand.

“This demand is driven by a critical need for a long-duration, non-flammable alternative to lithium at a time when the national security imperative could not be more important,” he said.

Despite the news, EOSE shares traded over 4% lower on Monday.

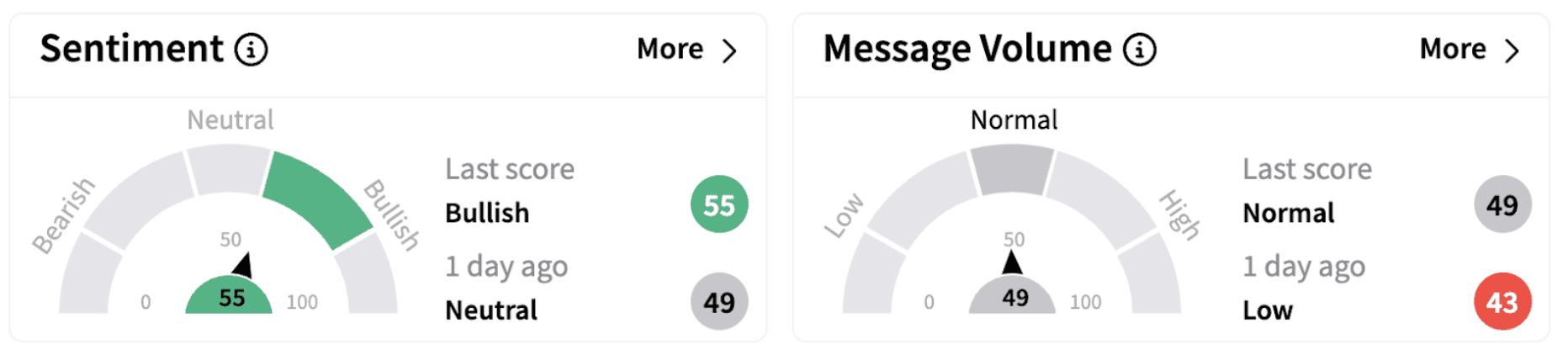

On Stocktwits, retail sentiment climbed into the ‘bullish’ territory (55/100) from ‘neutral’ a day ago.

Stocktwits users expressed optimism on the shares’ near-term prospects following the news.

Recently, Eos said it expects to achieve its revised $15 million revenue guidance for the full-year 2024 driven by increased customer deliveries during the fourth quarter.

Moreover, it expects to achieve 2025 revenue between $150 million and $190 million, driven by increased production volume on the company’s first state-of-the-art manufacturing line and continued strengthening of its overall supply chain.

Meanwhile, shares of Eos Energy have gained nearly 6% year-to-date and have risen over 414% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)