Advertisement|Remove ads.

ESAB Stock Receives Evercore Upgrade After Recent Selloff, Retail Stays Bullish

ESAB Corp (ESAB) stock fell about 2.7% over the past week, but Evercore ISI upgraded the stock to ‘In Line’ from ‘Underperform.’

According to The Fly, Evercore analyst David Raso set a price target of $120, compared to the earlier price target of $122. The new price target was roughly the same as the stock’s last closing price.

The company had forecast 2025 core adjusted earnings between $5.10 and $5.25 per share, compared with Wall Street’s estimate of $5.38 per share last week.

Evercore said that while it has trimmed the price, its analysis "suggests enough cushion is baked into ESAB's guide."

The analyst said that recent stock weakness, along with ‘a few elements that could break its way to render the guide particularly conservative.’

ESAB had forecast total core sales growth to be between flat and a negative 2% in 2025.

The company’s fourth-quarter sales had fallen 3% to $671 million.

The company, whose products are used in welding and gas control, had said its total sales in the Americas segment had declined 8%, hurt by the strengthening of the U.S. dollar compared to other currencies in the region.

The company expects foreign currency-related challenges to dent its sales in 2025 as well.

According to FinChat data, ESAB's forward price-to-earnings (PE) ratio is 24.1.

The PE ratio gauges a company's profitability.

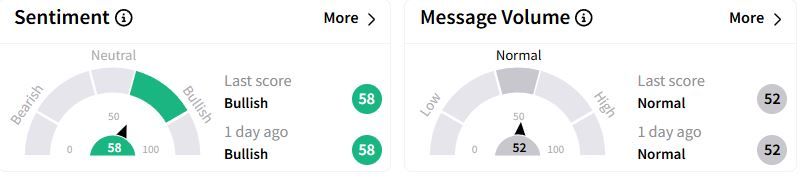

Retail sentiment on Stocktwits remained in the ‘bullish’ (58/100) territory, while retail chatter was ‘normal.’

Over the past year, ESAB stock has gained 29.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)