Advertisement|Remove ads.

Diamondback Energy Q4 Earnings Preview: Lower Oil Prices To Dent Bottom Line, Retail Remains Extremely Bullish

Diamondback Energy (FANG) stock gained retail attention ahead of the company’s fourth-quarter earnings report, which is scheduled for Monday after the bell.

According to Koyfin data, Wall Street expects Diamondback to report fourth-quarter earnings per share of $3.38 and revenue of $3.55 billion. The company has topped market expectations seven out of the last eight quarters.

Lower oil prices are expected to hurt the company’s earnings. In January, it posted average unhedged realized prices of $69.48 per barrel for the fourth quarter, compared with $76.42 per barrel last year.

According to The Fly, Raymond James analysts expected the company to beat earnings estimates on costs and capital expenditures. The firm also saw the energy company choosing free cash flow over growth.

The firm also noted that production efficiency gains among the U.S. oil and gas companies continued during the fourth quarter at a pace no one anticipated.

Its peers Devon Energy and Occidental Petroleum have topped quarterly profit estimates, helped by higher production.

The company had forecast fourth-quarter production between 840,000 and 850,000 barrels of oil equivalent per day.

Diamondback had bolstered its presence in the Permian basin last year by completing a $26 billion deal for privately held Endeavor Energy.

Last week, the company said it would buy certain assets of Double Eagle IV Midco subsidiaries in a $4.1 billion cash-and-stock deal.

It was also revealed last Thursday that CEO Travis Stice would step down and be replaced by Chief Financial Officer Kaes Van't Hof.

The oil and gas producer that Stice would become the executive chair of the board following the transition and remain in that position till the annual stockholders’ meeting in 2026

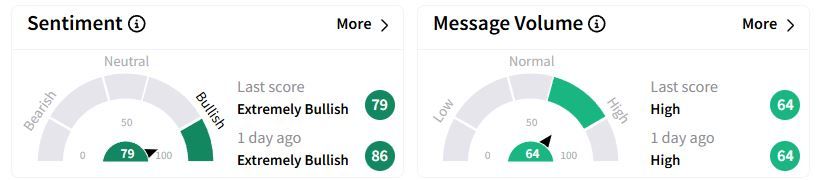

Ahead of the earnings report, retail sentiment on Stocktwits moved lower in the ‘extremely bullish’ (79/100) territory than a day ago, while retail chatter remained ‘high.’

Over the past year, Diamondback Energy shares have fallen 12.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)