Advertisement|Remove ads.

Esperion Therapeutics Stock Hits Near 1-Year High As Wall Street Sees Strong Risk-Reward Play On Demand For Cholesterol Drug

- Piper Sandler projected long-term growth backed by rising use of Esperion’s LDL-lowering therapies and expanding payer coverage.

- Q3 revenue rose sharply as U.S. product sales and collaboration income continued to strengthen.

- The recent Japan launch and milestones from partner Otsuka added to investor optimism about Esperion’s global expansion.

Esperion Therapeutics shares climbed to their highest levels in nearly a year on Tuesday after a bullish initiation from Piper Sandler and fresh progress on the company’s international launch plans helped lift investor sentiment.

The stock closed 16.4% higher at $3.69 on Tuesday and edged up another 0.3% in after-hours trading, also logging its best session in almost four months.

Piper Sandler Calls Esperion A Strong Risk-Reward Play

Piper Sandler initiated coverage with an ‘Overweight’ rating and projected a potential 144% upside, describing Esperion as a strong risk-reward play supported by accelerating demand for its cholesterol-lowering drug franchise. The firm highlighted the strength of the company’s bempedoic acid–based therapies, Nexletol and Nexlizet, and said it expects continued rapid volume and sales expansion as physicians shift toward non-statin low-density lipoprotein (LDL)-lowering options, according to a report by Investing.

The brokerage pointed to several drivers of long-term growth, including a wide label that covers primary prevention, evolving clinical guidelines that increasingly support the drug class, and broad payer access. A cardiologist-focused survey conducted by the firm reinforced confidence in the therapies’ adoption trajectory.

Piper Sandler said it expects Esperion’s products to reach over $650 million in peak U.S. sales, with additional contributions from ex-U.S. royalties, and noted that recent agreements with generic filers provide visibility into exclusivity extending to 2040.

Piper Sandler added that Esperion’s risk-reward profile is attractive, noting the stock trades at an enterprise value of roughly 10x estimated 2026 EBITDA, with high visibility into a long-term EBITDA compound annual growth rate above 30% from 2026 through 2031. This long-term view remains intact even as the company reported an EBITDA loss of $29.27 million over the last twelve months.

Esperion Posts Strong Q3 Growth

Esperion reported third-quarter (Q3) total revenue of $87.3 million, an increase of 69% year-on-year, with U.S. net product revenue rising 31% year-on-year to $40.7 million. Collaboration revenue strengthened as well, supported by higher royalty sales and product supply to partners. The company reported an EBITDA loss of $29.27 million, net loss of $31.3 million, and ended the quarter with $92.4 million in cash and cash equivalents. U.S. commercial coverage expanded to more than 90% of commercial lives and over 80% of Medicare beneficiaries, and total prescription volume increased during the period.

Japan Launch Builds Global Momentum

Esperion’s upward momentum comes shortly after a major international milestone. Last week, the company said that its partner Otsuka Pharmaceutical received National Health Insurance Price Listing in Japan and launched Nexletol for hypercholesterolemia and familial hypercholesterolemia. Japan represents the third largest global market for cardiovascular prevention, marking a significant expansion opportunity for Esperion’s cholesterol franchise.

Under the agreement, Esperion will receive a $90 million payment tied to Otsuka’s recent regulatory and pricing achievements. The company is also eligible for additional sales milestone payments and tiered royalties of 15% to 30% on net sales in Japan.

Stocktwits Traders Signal Long-Term Confidence

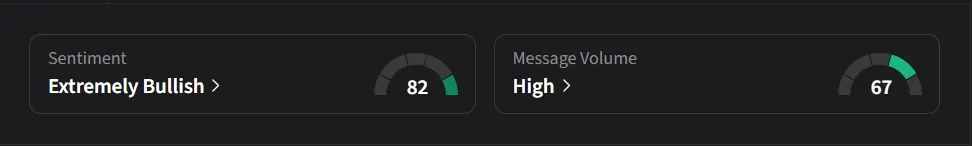

On Stocktwits, retail sentiment for Esperion was ‘extremely bullish’ amid ‘high’ message volume.

One user said they did not see a buyout happening soon, noting that Esperion already has a growing commercial drug, additional pipeline assets and a path toward profitability.

Another user said they expected to remain invested for 18 to 24 months, describing cardiovascular opportunities as early and ESP-2001 as still upcoming, and added that they had built a large position and planned to hold.

Esperion Therapeutics’ stock has risen 67% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)