Advertisement|Remove ads.

Eternal Q2 Preview: Blinkit Key To Next Leg Of Growth, Charts Hint At Bullish Momentum

Eternal (formerly known as Zomato) shares ended 2% higher on Wednesday ahead of its September quarter (Q2 FY26) earnings report due on October 16. Analysts expect the quick commerce giant to report a mixed set of numbers, reflecting strong revenue growth but weaker profitability.

In the Q2 earnings report, investors will be closely watching Blinkit's performance. According to SEBI-registered analyst Deepak Pal, Blinkit’s plans to adopt an inventory-led system may enhance profit margins. He also added that any regulatory change in foreign investment could impact FII sentiment.

Positive commentary or strong results could trigger a 5–8% upside move in the short term, but negative guidance may lead to a temporary correction, according to Pal.

Its quick commerce segment, Blinkit, has seen rapid expansion. Pal noted that the company is debt-free, and its working capital cycle has improved significantly, which is a positive sign. This indicates that the fundamental structure remains strong, although valuations are quite high, leading to elevated market expectations.

Eternal: What are technical charts showing?

Pal highlighted that the overall trend of Eternal stock remains clearly bullish, forming a consistent higher-high & higher-low pattern on both daily and weekly charts. Both chart structure and momentum indicators suggest that bullish sentiment remains intact.

He identified support at ₹336.50, ₹320, and ₹280 on the downside. Immediate resistance is seen at ₹355–₹360, with targets at ₹400–₹415.

Pal advised traders that fresh buying can be considered near ₹336–₹340 on dips, with a stop loss below ₹330 (on a closing basis). He pegged targets (3–4 months view) at ₹400 – ₹415, if bullish momentum continues.

Investment strategy: What should traders do?

Pal cautioned that Eternal’s growth story currently depends heavily on Blinkit’s performance. Valuations are high, but the long-term potential remains strong.

For short-term traders, ₹335 acts as a crucial support level. And for long-term investors, a close below ₹280 would be a red flag. Pal added that a volume breakout above ₹355–₹360 would confirm the next uptrend phase.

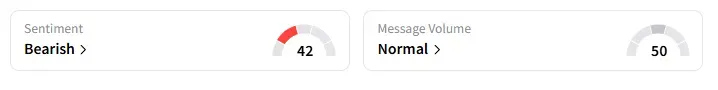

What is the retail mood on Stocktwits?

Data on Stocktwits showed that retail sentiment turned ‘bearish’ a day ago on this counter.

Eternal shares have risen 28% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)