Advertisement|Remove ads.

Tesla Stock’s Post-Election Rally Stalls But Analyst Talks Up His $500 Bull-Case Scenario: Retail Mood Stays Sour

Shares of Elon Musk-led electric-vehicle company Tesla, Inc. ($TSLA) fell sharply on Tuesday, snapping a five-session winning streak.

Tesla’s stock began to trend higher following the Oct. 23 earnings announcement, as it received a shot in the arm from better-than-expected third-quarter core auto margin and Musk’s guidance for 20%-30% deliveries growth in 2025.

The rally continued in the run-up to the 2024 presidential election as the Trump-Musk bonhomie gave a reason for traders to stay invested in the stock.

Trump’s victory fueled further gains in the stock, helping Tesla go past the $1 trillion market cap. Between Oct. 23 and Monday, the stock added a whopping 64%.

As the market pauses for a breather after its record run, the buying interest in Tesla has waned as well, with the EV maker underperforming the SPDR S&P 500 ETF Trust ($SPY) on Tuesday.

As of 1:00 pm ET, the stock was down 5.93% at $329.24.

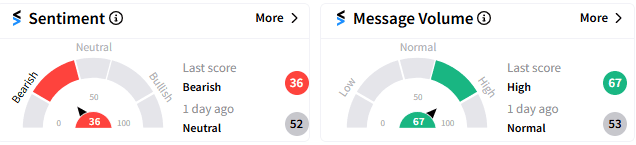

Retail mood toward the stock continues to be “bearish, with a reading of 36/100 on Stocktwits sentiment meter, but chatter regarding the stock remains at “high” levels.

A Stocktwits user said the shares could be headed to a support around $304.

Another raised the possibility of someone liquidating heavily all at once.

Morgan Stanley analyst Adam Jonas, however, is bullish on the stock, with his bull-case price target at $500. While noting that the company currently derives 80% of revenue from selling vehicles, the analyst said its total addressable market will expand to far wider domains in 2025 and over the next four years.

This possibility has not been factored in by buy-side or sell-side financial models, he said.

Delving into the 2030 assumptions underpinning his $500 bull-case, Jonas said the auto business is worth $90 per share, energy $85 per share, network services $146 per share, mobility and ride-share $118 per share, and third-party battery/powertrain at $61 per share.

The model, however, does not assign any explicit value for robotics/embodied artificial intelligence, beyond the automotive form factor, the analyst noted. That said, he sees Optimus worth about $100 per share, assuming every 1% of the 2024 U.S. labor force could be replaced by the company’s humanoid robot.

Tesla’s combined 2030 revenue will likely be $550 billion and earnings before interest, taxes, depreciation and amortization would be over $140 billion, he added.

Read Next: Altimmune Stock Jumps As Obesity Drug Candidate Clears Key FDA Meeting: Retail Bulls Charge In

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)