Advertisement|Remove ads.

Altimmune Stock Jumps As Obesity Drug Candidate Clears Key FDA Meeting: Retail Bulls Charge In

Gaithersburg, Maryland-based Altimmune, Inc.’s ($ALT) shares rose on Thursday after the company announced a positive outcome for the end-of-Phase 2 meeting with the FDA.

The clinical-stage biopharma that focuses on peptide-based therapeutics to treat obesity and liver diseases said it has successfully completed its end-of-the-Phase 2 meeting with the FDA regarding its obesity treatment candidate pemvidutide.

Pemvidutide is a novel peptide-based GLP-1/glucagon dual receptor agonist, currently being investigated for obesity and metabolic dysfunction-associated steatohepatitis (MASH).

Scott Harris, Chief Medical Officer of Altimmune, said, “We are pleased with the successful outcome of the End-of-Phase 2 meeting with the FDA. We continue to believe that pemvidutide is highly differentiated from other incretin-based agents currently available and in development.

Additionally, Altimmune said it had reached an agreement with the regulator regarding the design of a Phase 3 registration program for the drug candidate.

Vikim Garg, CEO of Altimmune, said, “Our interactions with the FDA regarding the Phase 3 development program have been incredibly productive, and this regulatory alignment represents a major accomplishment for our team.”

The Phase 3 obesity trial is designed to evaluate pemvidutide over a 60-week period, by enrolling about 5,000 subjects across four trials. The late-stage study will investigate three doses, namely 1.2 mg, 1.8 mg and 2.4 mg, and evaluate their safety and efficacy, with the intention of getting approval for all three doses.

Garg said, “Achieving this regulatory milestone is especially important as we advance our partnering efforts, approach the data readout from our Phase 2b IMPACT Trial in MASH and prepare IND submissions for additional indications.”

MASH results from a buildup of fat in the liver, leading up to inflammation and damage to the organ.

As of 10: 45 am ET, Altimmune shares were up 6.70% to $7.80.

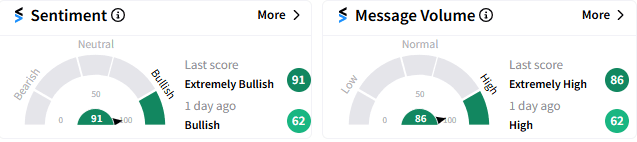

Altimmune was the top-trending stock on Stocktwits. The sentiment meter on the platform showed “extremely bullish" mood (91/100) toward the stock, accompanied by “extremely high” message volume.

Retailers were very positive about the company’s pipeline progress.

Read Next: Moderna Stuns Wall Street With Surprise Profit On Strong US Vaccine Sales, Cost Tightening

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)