Advertisement|Remove ads.

EVgo Stock Hits New 52-Week High After Energy Department Loan, JPMorgan Upgrade

Shares of EVgo, Inc. (EVGO) soared over 58% on Thursday, reaching a new 52-week high of $5.60 following two major developments that significantly boosted investor sentiment.

The U.S. Department of Energy announced it would provide EVgo with $1.05 billion in low-cost debt financing.

This funding aims to accelerate the expansion of EVgo’s fast-charging network across the country, enhancing access to reliable public charging stations.

Notably, this reportedly marks the first instance of financial support for an EV charger company from the Loan Programs Office (LPO) within the Department of Energy, as part of its innovative clean energy initiative.

EVgo, currently operating over 1,000 fast charging locations in more than 35 states, plans to use this financing to build approximately 7,500 additional fast charging stalls by 2030.

In alignment with the Biden-Harris administration’s Justice40 initiative, over 40% of the new stations will be situated in marginalized areas.

However, before accessing the funds, EVgo must meet specific technical, legal, environmental, and financial requirements set by the agency.

JPMorgan analyst Bill Peterson added to the positive momentum by upgrading EVgo from ‘Neutral’ to ‘Overweight’ with a $7 price target and placed the stock on “Positive Catalyst Watch.”

Unlike its peers in hardware and software, EVgo’s fast-charging owner-operator model has been scaling effectively, showing higher usage and charging rates despite the currently slow electric vehicle market, according to Peterson.

JPMorgan expects steady network growth, slight improvements in gross margins, and better operating efficiency to help EVgo reach breakeven adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) by the end of 2025, with growth expected after that.

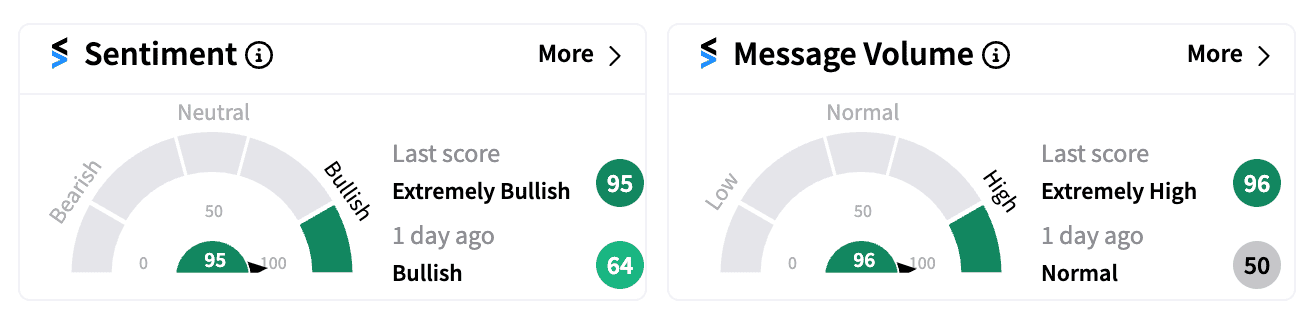

As a result, sentiment on Stocktwits surged to ‘extremely bullish’ (95/100), accompanied by a notable spike in message volume.

EVGO stock is up over 89% this year, outpacing competitors like ChargePoint Holdings Inc. (CHPT) and Blink Charging Co. (BLNK), which have seen declines of 38% and 45%, respectively.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244071754_jpg_8c7f1bc524.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trading_floor_jpg_e31b7b47cb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_til_cancer_resized_aba41aa312.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_align_technology_jpg_6ed1ce377f.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/startups-4-2025-09-5b99fcce94a97dfe0428474b29955652.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_generic_drug_resized_jpg_153bcda0db.webp)