Advertisement|Remove ads.

Eli Lilly’s Retail Investors Receive Dose Of Optimism From FDA Update On Weight-Loss Drug Supply, Analyst Insights

Shares of Eli Lilly and Company ($LLY) rose at the open on Thursday following a positive update from the Food and Drug Administration (FDA) regarding the availability of its weight-loss medication, tirzepatide injection.

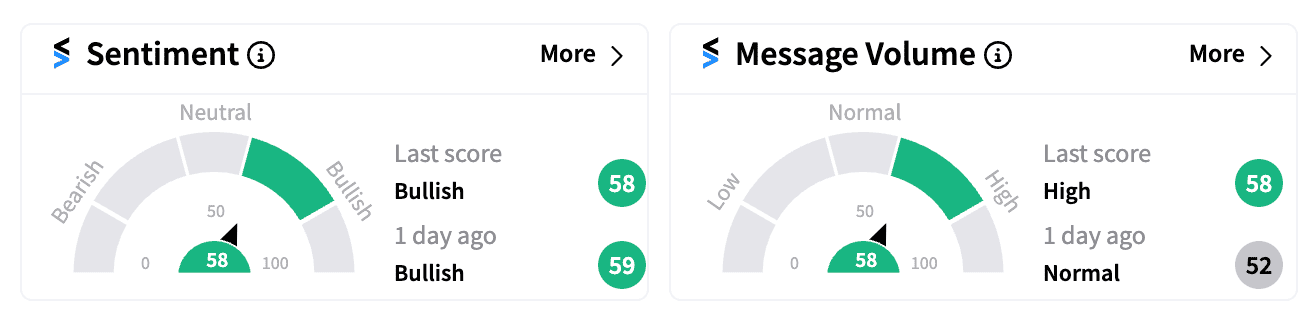

Retail sentiment on Stocktwits trended in the ‘bullish’ territory as investors reacted to the news.

The FDA announced that the shortage of tirzepatide injection, a glucagon-like peptide medication, has been resolved. The shortage, which began in 2022 due to soaring demand, has now been addressed, with the FDA confirming that Eli Lilly’s product availability and manufacturing capacity can meet current and projected national demand.

Deutsche Bank analyst James Shin maintained a ‘Buy’ rating on Eli Lilly, setting a price target of $1,025 after the FDA announcement. He noted that this development is positive for patients and aligns with Eli Lilly’s Q1 comments indicating that shipments would see meaningful increases in the second half of 2024.

The brokerage is now assessing whether increased stocking can bridge Q3 prescriptions to meet market expectations for tirzepatide.

This resolution allows the market to view Eli Lilly’s growth from a fundamental perspective rather than relying solely on momentum, suggesting the potential for meeting growth expectations set by analysts, according to Deutsche Bank.

However, the news raised concerns for smaller competitors like Hims & Hers (HIMS), which are trying to capture a share of the expanding weight-loss drug market.

Eli Lilly, once nearly acquired by a larger company in the 2000s, is on track to become the world’s first $1 trillion drugmaker by market value, as reported by the Financial Times. The company’s main challenge remains scaling up production to meet demand for its blockbuster diabetes and weight-loss drugs.

Sales of Mounjaro surged over threefold in the fiscal second quarter ending in June, reaching approximately $3.1 billion, with revenue from Mounjaro and Zepbound now constituting nearly 40% of Eli Lilly’s total sales.

On Wednesday, the firm announced a $4.5 billion investment to establish the Lilly Medicine Foundry, a new center dedicated to advanced manufacturing and drug development. This facility will enhance the company’s capacity to research new production methods while scaling up manufacturing for clinical trials.

As of the last close, LLY stock has surged 50% this year, reflecting strong investor confidence in the company’s growth trajectory.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2216097618_jpg_f1a89b53be.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_Blacvkwell_jpg_5a5410ddb9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/06/Solar-energy-jpg.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_emergent_biosolutions_jpg_bda7cf262d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_transmedics_jpg_8493ae6442.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2224252847_jpg_43a604ba48.webp)