Advertisement|Remove ads.

Exxon Sees Surge In Retail Chatter Ahead Of Q2 Earnings, Investors Eye Impact Of Lower Crude And Gas Prices On Margins

Exxon Mobil Corp. (XOM) saw a 150% increase in retail user message count over the last seven days, as it heads into its second-quarter (Q2) earnings on Friday and investors look for the impact of lower crude oil and natural gas prices on its margins.

The company is expected to post net revenue of $80.31 billion in Q2, representing a 10.5% year-over-year decrease, and earnings per share (EPS) of $1.53, according to data compiled by Fiscal AI.

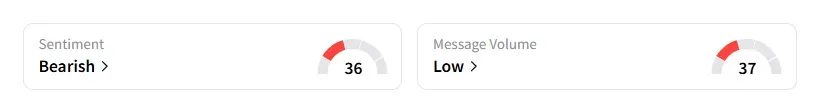

However, retail sentiment on the stock remains unchanged within the ‘bearish’ territory with chatter volumes at ‘low’ levels, according to data from Stocktwits.

Shares of the largest U.S. oil producer were up 1.2% during midday trading on Monday and have risen nearly 4% year-to-date.

In early July, Exxon had forecast that the lower oil and gas prices could reduce its second-quarter earnings by about $1.5 billion from the prior quarter's level.

Piper Sandler raised its price target on Exxon to $134 from $131 in early July and maintained an ‘Overweight’ rating, according to TheFly. The brokerage had then stated, based on the forecast Exxon provided, that there is a downside to Piper's prior estimate, driven primarily by lower-than-anticipated Energy Products contributions, as well as slightly lower anticipated upstream earnings.

From April to June, Brent crude oil prices experienced a dynamic and volatile trajectory reflecting softer global demand and cautious investor sentiment amid tariff-related uncertainties.

The stock has declined by nearly 4% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Nike Heads Toward 5-Month Highs After JPMorgan Upgrade: Retail Expects Stock To Hit $90-Mark

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)