Advertisement|Remove ads.

Nike Heads Toward 5-Month Highs After JPMorgan Upgrade: Retail Expects Stock To Hit $90-Mark

Nike (NKE) shares surged 4% in early trading on Monday to head toward a five-month high after JPMorgan upgraded the stock to ‘Overweight’ from ‘Neutral,’ citing a multi-year recovery for the company, driving high-teens to 20% annual earnings growth through fiscal 2030.

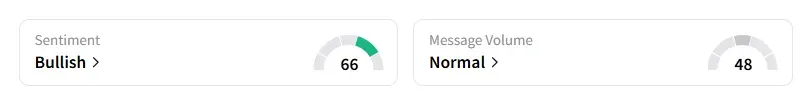

Retail sentiment on the stock improved to ‘bullish’ from ‘bearish’ a day ago, with chatter volumes at ‘normal’ levels, according to Stocktwits data.

The retail user message count on Nike increased by 167% in the last 24 hours on Stocktwits, with the stock on the watchlist of over 120,000 users on the platform.

JPMorgan also raised its price target on Nike to $93, up from $64, according to TheFly. The brokerage increased Nike's estimates for the first time in 13 months following its fieldwork and talks with management.

A bullish user on Stocktwits noted that the stock could rise to $90.

Nike executives in June had said the sportswear maker aimed to mitigate the impact of U.S. tariffs by reducing imports from China to the United States to the high single-digit range by the end of fiscal 2026.

Nearly 16% of Nike’s shoes imported into the U.S. are produced in facilities located in the world's second-largest economy. It has also announced price hikes on some of its products in the U.S. as it wrestles with costs tied to tariffs.

The stock is up nearly 5% so far this year and has increased by about 8% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2216479170_jpg_edce233c83.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)