Advertisement|Remove ads.

Fastenal Reports Marginal Rise In January Sales: Retail’s Not Impressed

Shares of Fastenal Co (FAST) traded in the green on Thursday after the company reported a 2% rise in January net sales to $652.24 million compared to the same period a year ago.

Daily sales averaged $29,647, marginally higher than the $29,085 figure reported in January 2024.

From a geographical point of view, the United States witnessed 1.7% daily sales growth during the month versus 0.7% seen in the year-ago period. Canada/Mexico witnessed 5.9% growth versus 4.8% in January 2024.

However, daily sales growth in the rest of the world declined by 8.8% compared to a 12.9% growth in the year-ago period.

Fasteners witnessed a decline in sales growth by 1.7% during the month compared to a 6% decline seen last year. Safety products saw a 3.7% growth versus 9.7% in January 2024.

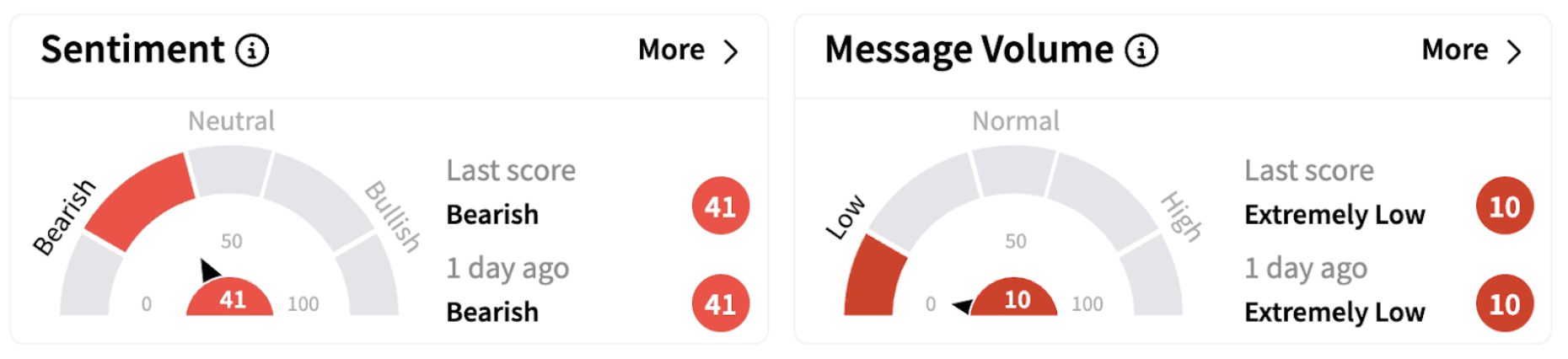

On Stocktwits, retail sentiment continued to trend in the ‘bearish’ territory.

Recently, Stifel lowered the firm's price target on Fastenal to $82 from $86 while keeping a ‘Hold’ rating on the shares.

According to The Fly, the brokerage said that even if the industrial macro environment remains depressed, Fastenal's market share gains support mid-single-digit revenue growth versus the slow 2.7% year-over-year growth reported in FY24.

Stifel said the mid-single-digit pace could accelerate to high single-digit or better when macro demand improves, but the timing of an FY25 recovery remains elusive.

Fastenal shares have risen over 3% in 2025 and are up over 6% over the past year.

Also See: Thermon Group Holdings Reports Mixed Q3 Earnings But Highlights Record Backlog: Retail’s Divided

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)