Advertisement|Remove ads.

Thermon Group Holdings Reports Mixed Q3 Earnings But Highlights Record Backlog: Retail’s Divided

Thermon Group Holdings, Inc. (THR), a provider of industrial process heating solutions, reported mixed third-quarter earnings on Thursday. Shares of the company traded 0.72% higher on Thursday morning.

Sales fell 1.5% in the third quarter to $134.4 million, compared to a Wall Street estimate of $138.91 million, according to FinChat. The decline was driven by continued headwinds in large project revenue, which fell 45% compared to last year.

Adjusted earnings per share (EPS) stood at $0.56 versus an estimated $0.55. Net income rose 17.1% YoY to $18.5 million.

CEO Bruce Thames said the growth in core earnings reflected the benefits of the strategic decisions to prioritize diverse end markets and to focus on recurring revenue streams from customer spending on maintenance and repair.

"These strategic pursuits helped to all but offset the lower revenue contribution from our project-related business, and we are well positioned to benefit from these initiatives while customer CAPEX spending recovers,” he said.

As of Dec. 31, the company’s backlog of $236 million was at a record high, up 48% from last year on a reported basis. The company reduced its net debt by $14 million during the quarter.

The company has repurchased $6.2 million in common shares under its existing share repurchase authorization in fiscal 2025, with $43.5 million remaining available as of Dec. 31, 2024.

CFO Jan Schott stated that the firm has ample financial flexibility to execute its capital allocation strategy, prioritizing investments in organic growth and complementary bolt-on acquisitions, debt paydown, and its $50 million share repurchase authorization.

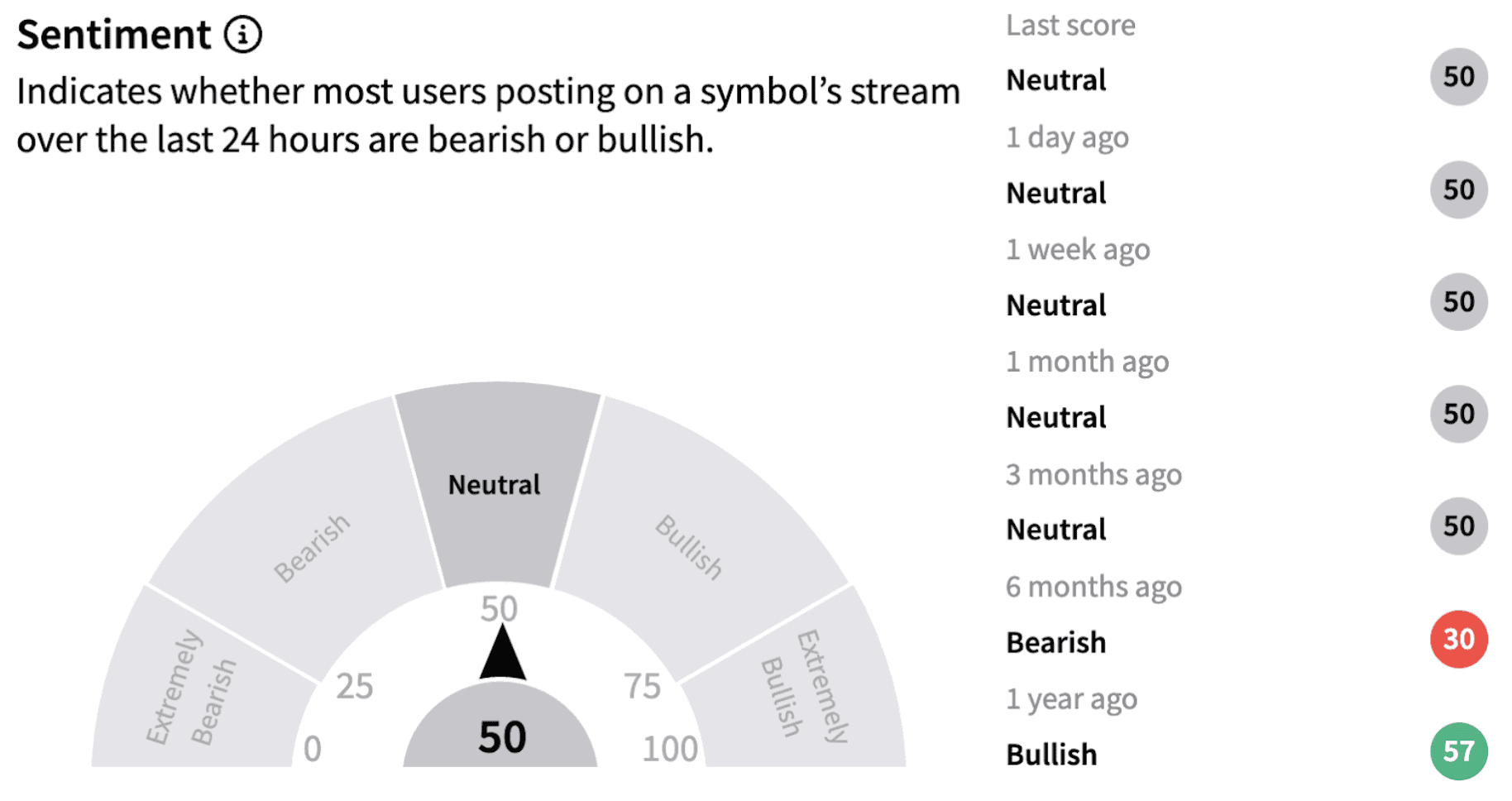

On Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory (50/100).

Thermon Group shares have lost over 5% in 2025 but are up nearly 6% over the past year.

Also See: Gates Industrial Reports Better-Than-Expected Q4 Earnings: Retail’s Unswayed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)