Advertisement|Remove ads.

Fastly Surges 42% Pre-Market Today — Agentic AI Traffic 'Still In Infancy', Says William Blair

- The firm explained that usage tied to both large language models and next-generation AI agents could become a longer-term catalyst.

- William Blair also noted that, beyond AI-specific demand, Fastly secured broader agreements with clients.

- The company posted a fourth-quarter revenue of $172.6 million and adjusted earnings per share of $0.12, both above street estimates.

Fastly Inc. (FSLY) received a vote of confidence from William Blair, which raised its rating on the cloud computing and edge platform company, citing increasing demand driven by emerging artificial intelligence applications.

The firm upgraded the stock to ‘Outperform’ from ‘Market Perform’ without assigning a specific price target, according to TheFly.

The company posted a fourth quarter (Q4) revenue of $172.6 million and adjusted earnings per share (EPS) of $0.12, both surpassing the analysts’ consensus estimates of $161.36 million and $0.06, respectively, according to Fiscal AI data.

Fastly stock traded over 42% higher in Thursday’s premarket.

AI Demand Still In ‘Infancy,’ Says Analyst

William Blair pointed to a standout quarterly performance fueled in part by expanding activity linked to agent-driven artificial intelligence tools, and added that the contribution from agentic AI “is still in its infancy”.

The firm explained that usage tied to both large language models and next-generation AI agents could become a longer-term catalyst. William Blair also said that beyond AI-specific demand, Fastly secured more expansive agreements with clients committing to broader deployments that span content delivery, cybersecurity services, and computing capabilities.

Retail Traders Turn Extremely Bullish

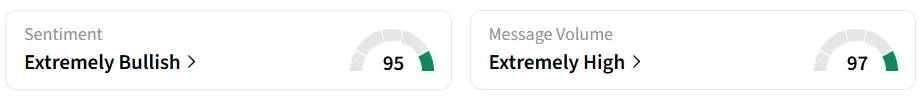

On Stocktwits, retail sentiment around Fastly jumped to ‘extremely bullish’ from ‘neutral’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock saw a whopping 1,392% increase in retail messages over a 24-hour period.

A bullish Stocktwits user said the stock is ‘undervalued’ and has the potential to grow big.

In 2026, the company expects revenue to be between $700 million and $720 million.

FSLY stock has declined by over 7% in the last 13% months.

Also See: Novo Looks To Ireland To Scale Production Of Wegovy Pill: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)