Advertisement|Remove ads.

Federal Bank bets on high-yield loans to drive profitable growth

Venkatraman Venkateswaran, Executive Director of Federal Bank, added a note of caution, saying the bank will take a “one quarter at a time” approach to performance, particularly with potential interest rate cuts on the horizon.

Kerala-based Federal Bank is positioning itself for steady, profitable growth through a strategic focus on high-yield lending segments, even as overall loan growth appears modest. Executive Director Venkatraman Venkateswaran said the bank expects continued momentum in targeted areas, reflecting a deliberate strategy to balance growth with returns.

“We expect to see [loan against property and business banking] coming back very strongly,” Venkateswaran said, highlighting the medium-yielding segments showing a clear turnaround after previous de-growth.

The bank’s performance in selected profitable segments has been robust. Commercial banking grew 7% quarter-on-quarter (QoQ), commercial vehicle and construction equipment (CVCE) lending expanded 4%, and card loans rose nearly 4.5%. Retail gold loans, a key focus area, increased 7% QoQ, even though headline gold loan growth was only 3%.

Venkateswaran explained that overall retail growth of around 1.5% reflects the bank’s balance sheet composition rather than weak demand. “Nearly 50% of advances is in home loan and corporate segments, which contribute the least at this stage to the margins,” he said, emphasising that the strategy prioritises profitable growth over sheer volume.

Also Read: Banks’ second quarter FY26 outlook: Loan growth steady, margins tighten

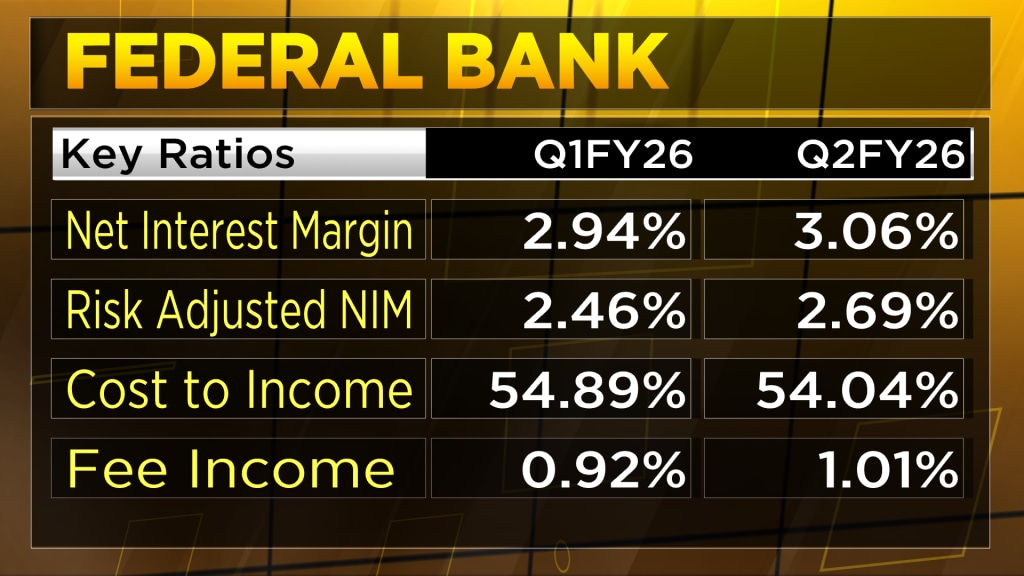

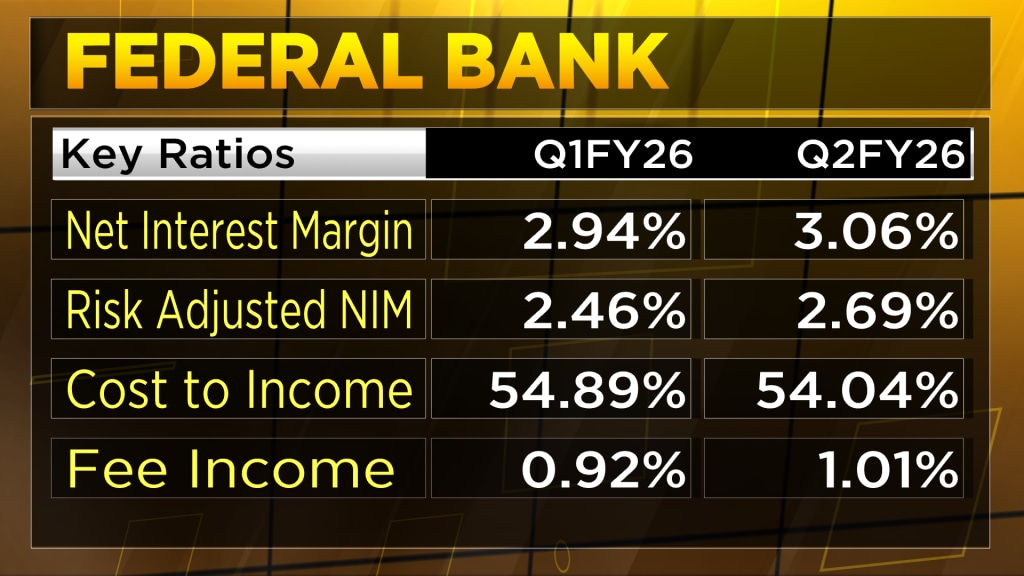

Looking ahead, the bank is confident about the trajectory of net interest margins (NIMs). While avoiding specific forward guidance, Venkateswaran said, “the growth trajectory on NIMs will continue to be strong. We obviously want to grow the NIMs from the current levels.” He added a note of caution, stating the bank will approach performance “one quarter at a time,” especially with potential interest rate cuts on the horizon.

The market capitalisation of Federal Bank is around ₹55,918.70 crore. Its shares have gained close to 18% in the past year.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

“We expect to see [loan against property and business banking] coming back very strongly,” Venkateswaran said, highlighting the medium-yielding segments showing a clear turnaround after previous de-growth.

The bank’s performance in selected profitable segments has been robust. Commercial banking grew 7% quarter-on-quarter (QoQ), commercial vehicle and construction equipment (CVCE) lending expanded 4%, and card loans rose nearly 4.5%. Retail gold loans, a key focus area, increased 7% QoQ, even though headline gold loan growth was only 3%.

Venkateswaran explained that overall retail growth of around 1.5% reflects the bank’s balance sheet composition rather than weak demand. “Nearly 50% of advances is in home loan and corporate segments, which contribute the least at this stage to the margins,” he said, emphasising that the strategy prioritises profitable growth over sheer volume.

Also Read: Banks’ second quarter FY26 outlook: Loan growth steady, margins tighten

Looking ahead, the bank is confident about the trajectory of net interest margins (NIMs). While avoiding specific forward guidance, Venkateswaran said, “the growth trajectory on NIMs will continue to be strong. We obviously want to grow the NIMs from the current levels.” He added a note of caution, stating the bank will approach performance “one quarter at a time,” especially with potential interest rate cuts on the horizon.

The market capitalisation of Federal Bank is around ₹55,918.70 crore. Its shares have gained close to 18% in the past year.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_UAL_New_47917d2c93.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_national_cancer_institute_Cx0_Ls_Yr_M_Ns_unsplash_b3dc9b6ace.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cleveland_cliffs_OG_jpg_53ba327db1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2226816968_jpg_f7de55409b.webp)