Advertisement|Remove ads.

Ferrari Stock Zooms To 3-Month High On Big Q4 Beat: Retail Traders Join The Bull Ride

U.S.-listed shares of Ferrari NV (RACE) surged more than 7% on Tuesday, hitting their highest level since early November after the luxury automaker posted stronger-than-expected fourth-quarter earnings.

The stock was also on track for its best single-session gain in over a year as bullish sentiment from retail traders flooded Stocktwits.

Ferrari reported fourth-quarter adjusted earnings of €2.14 ($2.21) per diluted share, well above the €1.90 analysts had expected and a sharp rise from €1.62 in the year-ago quarter.

Net revenue climbed to €1.74 billion, surpassing the consensus estimate of €1.66 billion and improving from €1.52 billion in the same period last year.

Looking ahead, the company expects full-year 2025 adjusted diluted EPS of at least €8.60 and net revenues of at least €7 billion, while analysts forecast €8.83 per share and €7.13 billion in sales.

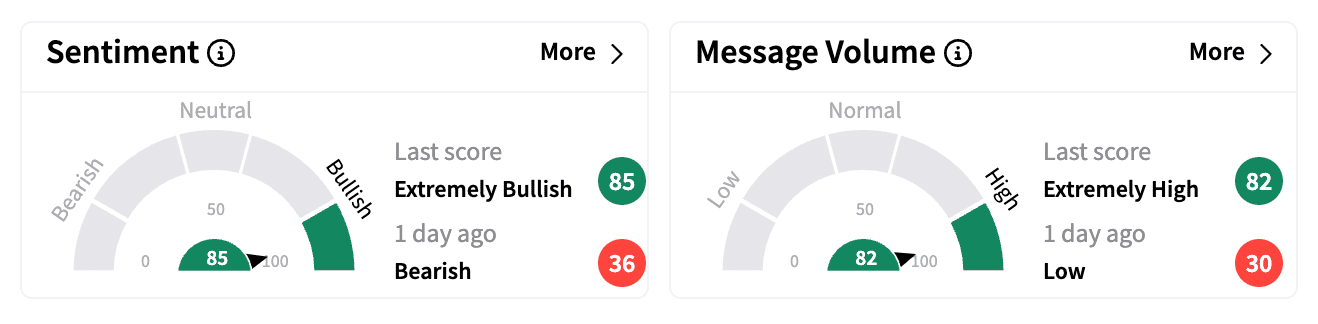

Stocktwits sentiment flipped from bearish to ‘extremely bullish’ following the earnings release, with message volume spiking as traders piled into the stock.

“Quality of revenues over volumes: I believe this best explains our outstanding financial results in 2024, thanks to a strong product mix and a growing demand for personalizations,” said CEO Benedetto Vigna.

He also pointed to the company’s investments in innovation, including the new Ferrari F80 supercar, the E-Cells Lab for advanced battery research, and the e-building, a facility dedicated to the future of Ferrari’s electrification strategy.

Vigna said Ferrari is set to reveal more about its long-term vision at its Capital Markets Day In October.

Barron’s reported that unlike many high-end automakers, Ferrari’s relatively low exposure to China has helped its stock outperform rivals such as Mercedes-Benz Group over the past year.

Analysts have reportedly argued that Ferrari’s ability to sustain demand above supply — along with the launch of its $3.8 million supercar — would continue to drive earnings growth.

The Italian auto giant has no plans to accelerate U.S. sales in response to potential tariffs, its CEO said.

Ferrari’s NYSE-listed stock has gained more than 23% over the past year.

(1 Euro = $1.04)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)