Advertisement|Remove ads.

Pre-Market Movers: Retail's Pulse On Faraday Future, Nvidia and VBI Vaccines

U.S. stocks closed mixed Tuesday, with the Dow Jones rising ahead of key earnings and Fed decisions. Before the opening bell on Wednesday, Faraday Future, Nvidia, and VBI Vaccines are drawing significant market attention from the list of most actively traded stocks.

Faraday Future Intelligent Electric Inc. (FFIE): Faraday Future stock surged over 21% to $0.38 pre-market after regaining Nasdaq compliance. The EV-maker reported a reduced operating loss of $43.60 million in Q1 from $95.80 million a year ago, and operating expenses fell from $95.80 million to $22.90 million.

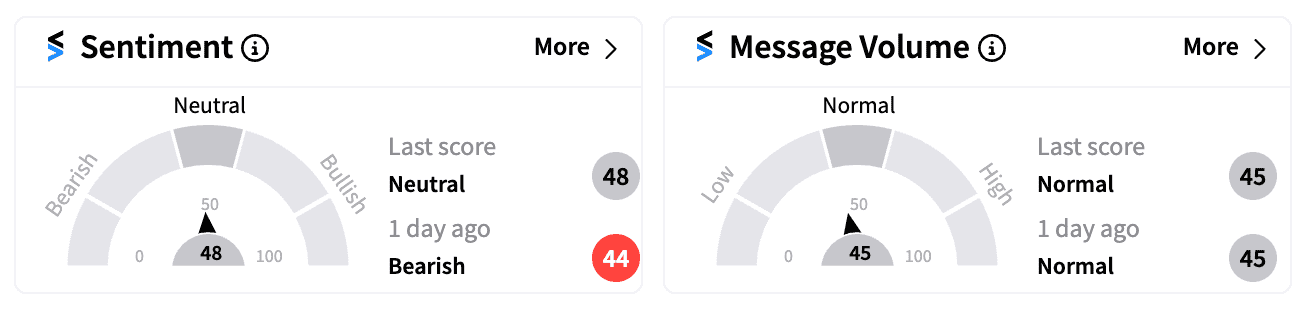

Last week's Investor Community Day also boosted sentiment. Short interest has dropped to 7.76% from the start of the year. Stocktwits sentiment improved from bearish to neutral (48/100).

Nvidia Corp. (NVDA): Nvidia shares are up alongside other chip stocks premarket, likely due to AMD's strong Q2 and whispers of potential new export rules benefiting chipmakers. The Biden administration is reportedly contemplating tweaking a rule on foreign chip equipment exports, which could exempt Japan, the Netherlands, and South Korea.

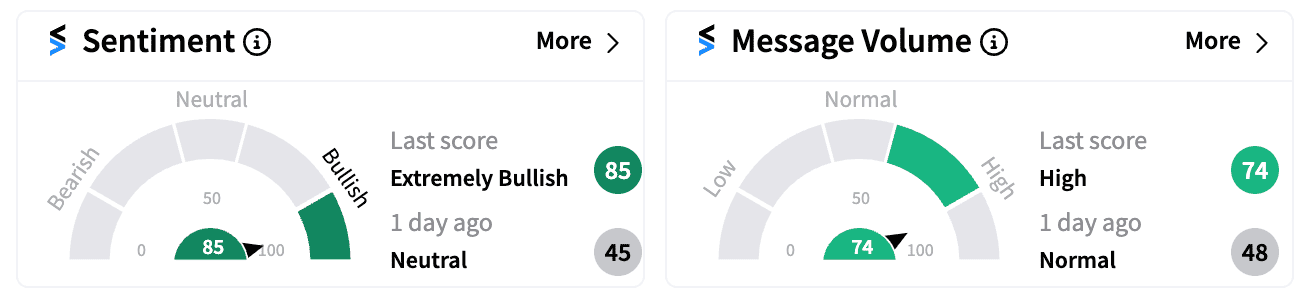

Stocktwits data showed that NVDA’s retail following turned more cheerful on this development, as the sentiment score flipped from neutral a day earlier to extremely bullish (85/100) amid high message volumes. Nvidia is due to report Q2 results on Aug. 28 after market close.

VBI Vaccines Inc. (VBIV): VBI Vaccines rose nearly 3% pre-market after crashing over 77% in the previous session following the biopharma company's bankruptcy plan and asset sale announcements. It is seeking creditor protection in Canada and expecting to be delisted from the Nasdaq.

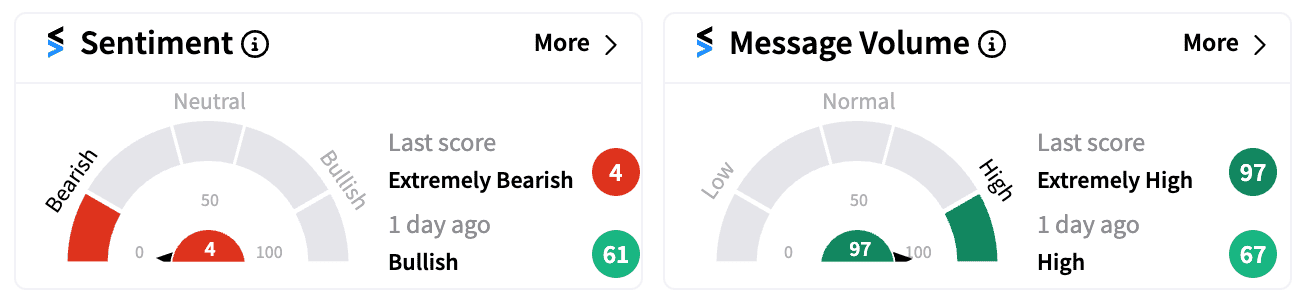

The firm also intends to file for Chapter 15 bankruptcy in the U.S. Stocktwits sentiment reflected investors’ gloom as retail sentiment hit extremely bearish levels (4/100), the lowest this year. At the same time, message volumes reached a 2024 peak at 'extremely high' (97/100) levels.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)