Advertisement|Remove ads.

FirstCry Parent Slips 6% As Losses Widen: SEBI RA Dhwani Patel Flags Weak Technicals

Brainbees Solutions shares fell over 6% on Tuesday, led by dismal March-quarter earnings.

The parent company of FirstCry reported a significant increase in its fourth-quarter (Q4 FY25) net loss at ₹111 crore, widening from ₹43 crore a year ago. Revenues, however, grew 16% to ₹1,930 crore.

The losses include a one-time exceptional charge of ₹36.7 crore during the quarter.

For the full financial year, the company managed to trim losses to ₹265 crore, with revenue up 18% to ₹7,660 crore.

On the technical charts, SEBI-registered analyst Dhwani Patel highlighted that the stock is in a downward trend.

While there are signs of a base formation around ₹300 - ₹310 levels, a clear confirmation of trend reversal can be established if the stock closes above ₹385 - ₹390.

Until such a breakout, Patel holds a ‘neutral’ view on the counter.

Meanwhile, domestic brokerage JM Financial maintains a ‘buy’ rating but revised the target price lower to ₹488, indicating a 30% upside.

They believe the company retains its deeply-moated position in its category and will be a key beneficiary of tax benefits and any recovery in discretionary spends.

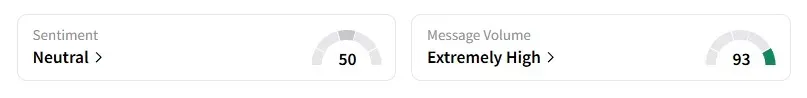

Data from Stocktwits shows that while the retail chatter is ‘extremely high’, the retail sentiment remains ‘neutral’ on the counter.

Brainbees Solutions shares are down 45% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)