Advertisement|Remove ads.

Fiserv Stock Lands Another Downgrade On Wall Street After Nosedive — Analyst Says Turnaround ‘Will Take A While’

- A record 102.6 million Fiserv shares changed hands on Wednesday, according to Koyfin data, after the firm slashed its annual organic revenue growth forecast.

- Separately, TD Cowen analysts noted that the level and pace of business slowdown was "baffling."

- Retail investors on Stocktwits remained ‘bullish’ on the stock, with some saying it was a good time to buy.

Truist analysts reportedly downgraded Fiserv stock after it slumped by more than 44% on Wednesday, logging the worst trading session since it became a public firm.

The shares of the financial services firm closed at $72.38, compared with its 200-day simple moving average of $173.41. A record 102.6 million Fiserv shares changed hands on Wednesday, according to Koyfin data, after the firm slashed its annual organic revenue growth forecast to 3.5% to 4% compared with 10% projected earlier.

Fiserv CEO Mike Lyons cited multiple reasons behind the dramatic cut, including overly optimistic growth expectations in Argentina and the company's focus on lowering costs rather than delivering effective products.

What Did Truist Analysts Say?

According to The Fly, Truist downgraded the stock to ‘Hold’ from ‘Buy,’ and lowered the price target to $75 from $43. The updated price target implied a 3.6% upside from the stock’s Wednesday closing price. Several other Wall Street analysts also downgraded the stock on the large cut in forecast.

Truist reportedly said that its previous bull case centered on Fiserv’s Clover platform as a high-quality acquisition asset that would continue to take market share and that the stock was still attractive on a growth-adjusted basis. The Truist analyst struggled to "make either argument" following the outlook and noted the turnaround story "will take a while to play out."

Fiserv helps clients with account processing, digital banking, and payments, including credit and debit card processing, merchant acquiring, and e-commerce solutions.

Separately, TD Cowen analysts noted that the level and pace of business slowdown was "baffling," before adding that lower structural growth messaging, the initiation of a remediation plan, and leadership shuffling left the brokerage “questioning how things changed so quickly."

Fiserv also stated on Wednesday that former Global Payments executive Paul Todd would become the company’s Chief Financial Officer, effective Oct. 31, succeeding Robert Hau.

What Is Retail Thinking?

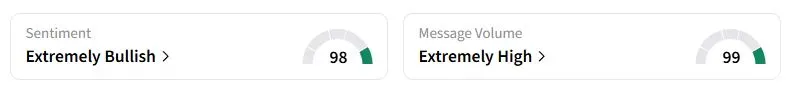

Retail sentiment on Stocktwits about Fiserv was in the ‘extremely bullish’ territory at the time of writing, compared with ‘bullish’ a day ago.

“Bad earnings and management shake-up are priced at this point. It’s a good time to buy,” one trader said.

“Expecting a nice bounce from this state of utter carnage for the long-term holders,” another trader said.

Including the session’s losses, Fiserv stock has fallen over 65% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)