Advertisement|Remove ads.

NuScale Power Stock To $50? SMR Draws Bullish Buzz As Partner Firm Set To Gain $25B From US-Japan Pact

- The investment in the Houston-based company was announced alongside a host of other projects during U.S. President Donald Trump’s visit to Japan.

- NuScale said ENTRA1 Energy will develop a fleet of power plants utilizing baseload energy sources.

- The investment pledge comes more than a month after Entra1’s agreement with the Tennessee Valley Authority (TVA) to develop up to 6 gigawatts of new clean baseload power using NuScale’s small modular reactor.

NuScale Power (SMR) stock garnered some upbeat chatter on Stocktwits late Wednesday after the company revealed that its exclusive global strategic partner, Entra1 Energy, could receive up to $25 billion in capital as part of Japan’s $550 billion investment in the U.S.

The investment in the Houston-based company was announced alongside a host of other projects following a meeting between U.S. President Donald Trump and Japanese Prime Minister Sanae Takaichi in Tokyo. However, the White House did not reveal how much Entra1 could potentially gain.

NuScale said ENTRA1 Energy will develop a fleet of power plants utilizing baseload energy sources. The program will serve fast-growing energy demand from AI data centers, manufacturing, and national defense, and create thousands of jobs in the U.S.

Why Are Some Retail Traders Excited?

The investment pledge comes more than a month after Entra1’s agreement with the Tennessee Valley Authority (TVA) to develop up to 6 gigawatts of new clean baseload power using NuScale’s small modular reactor technology. Entra1 and NuScale first launched a partnership in 2022, with NuScale agreeing to operate the SMRs in the future and Entra1 selling the power to customers.

“We are proud to support Entra1 Energy as they take part in this historic agreement between the United States and Japan,” said John Hopkins, CEO of NuScale. “This collaboration underscores the central role of advanced nuclear in powering our economy, strengthening alliances, and providing the reliable energy needed for AI, manufacturing, and critical infrastructure.”

What Is Retail Thinking?

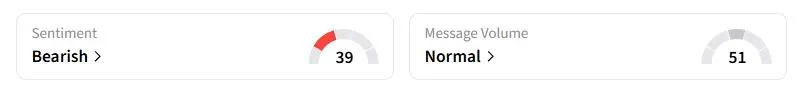

Retail sentiment on Stocktwits about NuScale was in the ‘bearish’ territory at the time of writing, but the firm was drawing some bullish chatter.

One user wrote that the stock should reach $50 soon, following the development.

"$SMR Overnight price - 45. Morning it will be 50+" said another bullish watcher.

NuScale stock has more than doubled this year, amid optimism surrounding the nascent sector. NuScale’s first nuclear reactor could become operational by 2029, and it remains the only SMR design approved by U.S. regulators.

Also See: Why Did Insecticide Maker FMC Corp’s Stock Tumble Over 26% After-Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)