Advertisement|Remove ads.

Five9 Stock Poised To Record Biggest Gain In Over 2 Years On AI-Powered Q4 Beat: Retail Upbeat

Five9, Inc. (FIVN) shares skyrocketed nearly 15% in Thursday’s after-hours session after the provider of a virtual contact center cloud platform reported better-than-expected fiscal year 2024 fourth-quarter results and issued positive forward guidance.

The San Ramon, California-based company reported fourth-quarter adjusted earnings per share (EPS) of $0.79 versus $0.61 earned a year earlier. The bottom-line result exceeded the Finchat-compiled consensus estimate of $0.70 and the guidance range of $0.69 to $0.71.

Quarterly revenue climbed 17% year over year (YoY) to $278.7 million, more than the consensus of $267.70 and the guidance of $267 million to $268 million.

Five9’s margins expanded, with the adjusted gross margin rising YoY to 63.5% from 61.3% and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin to a record 23.1% from 20.2%.

CEO Mike Burkland said, “We are very pleased to report strong year-end results, with 2024 annual revenue exceeding $1 billion.” He noted that fourth-quarter subscription revenue grew 19% and operating cash flow was a record $50 million.

The executive also noted that the company’s enterprise artificial intelligence (AI) revenue climbed 46% YoY.

Burkland said, “We believe we are well positioned with our AI-powered platform and trusted AI experts to continue driving durable long-term growth and look forward to building on our momentum in 2025.”

Five9 expects adjusted EPS of $0.47 to $0.49 for the first quarter and $2.58 to $2.62 for the full year. This compares to the consensus estimates of $0.48 and $2.54.

It guided revenue in the range of $275.1 million to $272.5 million for the quarter and $1.14 billion to $1.144 billion for the year. The outlook was above the $272.18 million and $1.03 billion consensus estimates.

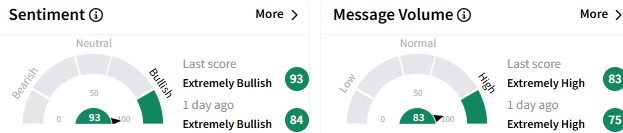

On Stocktwits, retail sentiment toward Five9 stock remained ‘extremely bullish’ (93/100) and the message volume stayed ‘extremely high.’

A watcher said the stock could head toward $80, and that the rally was just beginning.

Another user listed the stock among the top earnings beaters from late Thursday, adding that the long-term story is intact.

In the after-hours session, Five9 stock climbed 14.66% to $47.80, marking the highest level in more than eight months. If the gain carries over into Friday’s regular trading, the stock is on track to record its biggest one-day advance since November 2022, based on data from Koyfin.

The stock has gained 2.6% so far this year.

For updates and corrections, email newsroom@stocktwits.com

Read Next: AI, Crypto, Cannabis Or EVs? Retail Investors Pick Their Top Speculative Bet For 2025

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)