Advertisement|Remove ads.

AI, Crypto, Cannabis Or EVs? Retail Investors Pick Their Top Speculative Bet For 2025

The U.S. stock market is on an extended bull run that started in October 2022, pushing up valuations to unsustainable levels in some cases. But bulls argue that the rally has further legs as it broadens. Against this backdrop, we asked Stocktwits users about the speculative industry they are most bullish about in 2025.

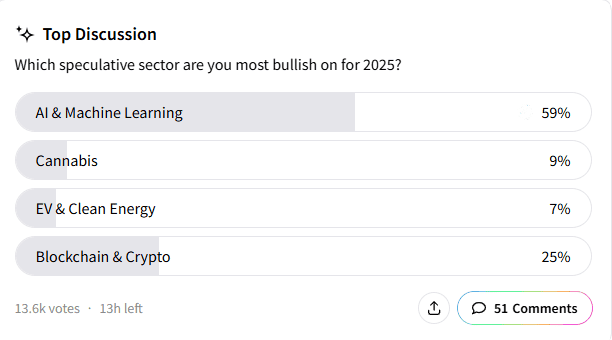

Here are the findings from the poll that attracted 13,500 responses and 51 comments:

- 59% of the respondents said they were most bullish about artificial intelligence (AI) and machine learning (ML)

- 25% picked blockchain and crypto

- 9% reposed faith in the cannabis industry

- A more modest 7% backed electric vehicle (EV) and clean energy industry

Optimism Vs. Euphoria

The outlook for these sectors largely depends on whether the market rally sustains its momentum.

Carson Group Chief Market Strategist Ryan Detrick shared a chart showing that past bull markets that extended to three years lasted an average of eight years.

However, Andrew Slimmon, the Head of the Applied Equity Advisors Team at Morgan Stanley Investment Management, issued a cautionary tone. He asked investors to watch for "signs" of sustained retail stock purchases and "aggressive" net fund flows near 2021 levels.

He said net fund flows totaled less than $100 billion in the second half of 2024, compared to $1.2 trillion in 2021 when signs of exuberance existed.

Slimmon expects the Federal Reserve to help determine how quickly the current bull market runs its course. According to the strategist, measured rate cuts could extend the optimism phase while more aggressive easing could tip sentiment to euphoria.

AI Mania

The poll findings reflect exuberance toward one of the most hot-and-happening technologies that has taken the world by storm.

Morgan Stanley's Slimmon said the huge commercial embrace of AI and the resulting productivity boom could lead to a stronger and longer bull market, just like the internet boom of the late 1990s.

The case for this expectation becomes more potent with an AI-friendly President.

A watcher on Stocktwits said AI stocks is like having a "GameShark" for life. Another user said the next iteration of AI and ML, namely "generative AI (GenAI) is a big deal, while one backed robotics as a game-changer.

Crypto Has Takers

The cryptocurrency industry could benefit from more mainstream acceptance and an easing of the regulatory environment under President Donald Trump's administration.

Bitcoin ended 2024 as one of the best-performing financial assets and topped the $100,000 mark for the first time in early December. However, it has pulled back below the level since.

A Stocktwits user foresaw a stock dump from current levels and said they would invest only in good crypto coins. Another touted XRP, the native currency of the Ripple network, is the one with the most significant upside potential.

Pot Has Key Catalyst

A watcher pointed to the Drug Enforcement Administration (DEA) rescheduling slated for the first quarter. Moving marijuana from Schedule I, comprising substances having no medical use, to Schedule III of the Controlled Substances Act (CSA) is seen as a significant step toward across-the-board legalization.

EV Lags

The EV industry is fraught with fundamental weakness due to the slowing adoption of these new-energy vehicles and Trump's decision to cancel federal tax credits. The fortunes of Tesla, Inc.,(TSLA) the frontrunner in the race, hinge on the company's ancillary businesses, and startups are struggling to stay afloat.

Alt Favorites

Not all are excited about these industries that have caught investors' attention. One user said that none of the four options provided in the poll will emerge as winners in 2025.

Some believe that not "clean energy" but oil and gas would emerge as the winners. That may not be a farfetched guess, given Trump's "drill baby, drill" mantra.

Another user placed hopes on REITs, land, oil, and gold. The yellow metal has been on a tear of late amid the economic uncertainties, with gold futures tantalizingly close to hitting the $3,000-a-troy-ounce mark.

For updates and corrections, email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)