Advertisement|Remove ads.

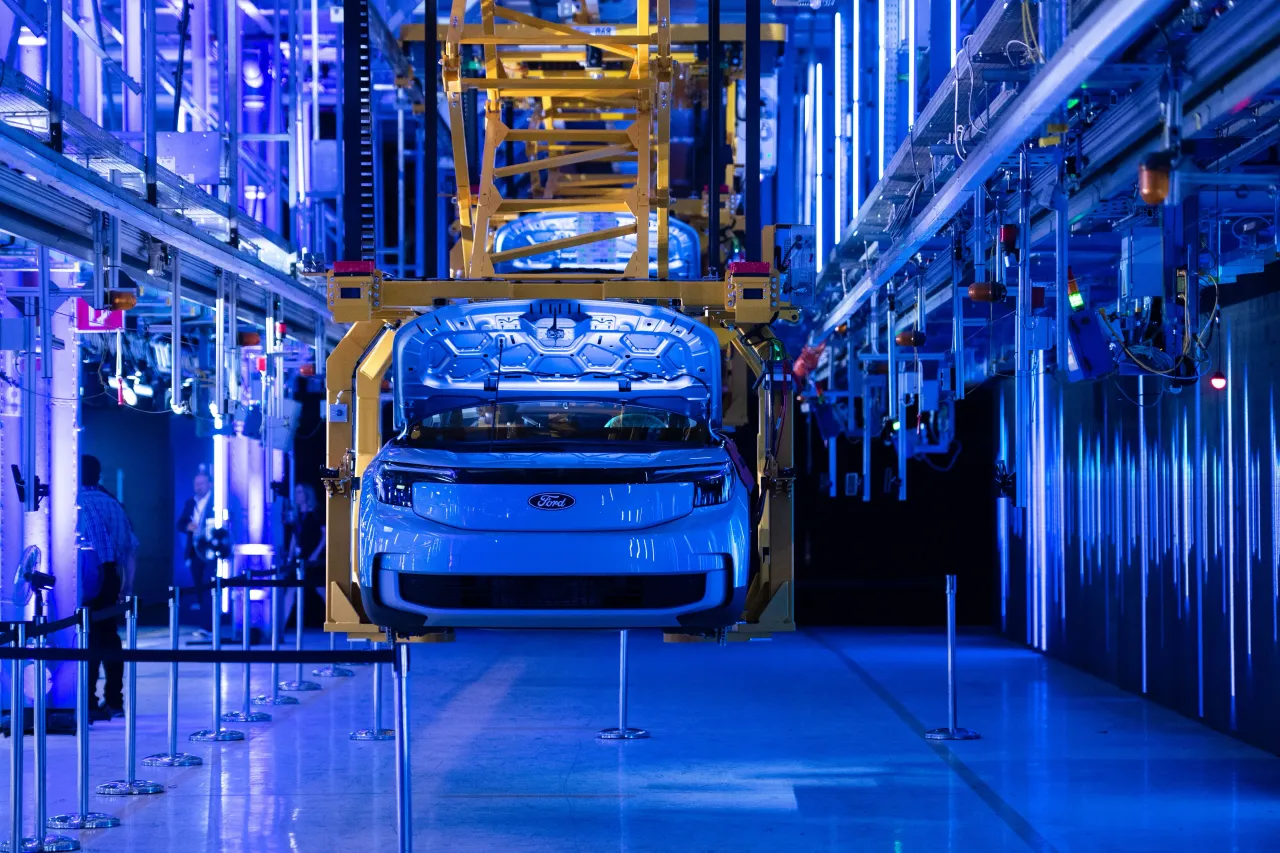

Ford’s Kentucky Battery Plant Workers Win Vote To Unionize BlueOval SK

The United Auto Workers (UAW) won a vote to unionize Ford’s joint-venture BlueOval SK battery plant in Kentucky, though it disputed 41 pending challenge ballots as illegitimate.

The union urged Ford to recognize that a majority of production and maintenance workers had chosen to join, accusing the company of trying to undermine the outcome, Reuters reported.

The BlueOval SK venture, a $7 billion partnership between Ford and SK On, expects to employ 5,000 workers across two Kentucky battery plants once fully operational.

About 1,450 employees currently work at the first site, which began production this summer, while the second facility remains delayed. The Kentucky plants produce batteries for Ford’s EVs, including the F-150 Lightning.

UAW President Shawn Fain has emphasized the importance of organizing EV and battery facilities, calling them a key battleground as the industry transitions to electrification.

The push comes after mixed results in the South, including a win at Volkswagen’s Tennessee plant in 2023, but a loss at Mercedes’ Alabama facility in May 2024. The union has also previously secured victories at GM’s Ultium Cells battery joint ventures in Ohio and Tennessee.

The vote comes as Ford faces a tougher landscape for electric vehicles.

The Wall Street Journal reported in July that Ford had scaled back in Kentucky, operating just one of its battery plants while leaving the second one idle.

However, a Ford spokesperson told Stocktwits in an email that it is not scaling back in Kentucky, pointing instead to a $2 billion investment unveiled in August as part of a broader $5 billion EV strategy.

The plan includes the launch of a new Ford Universal EV Platform and Production System, with a mid-size, four-door electric pickup to be assembled at its Louisville Assembly Plant starting in 2027. CEO Jim Farley described the initiative as a “Model T moment” aimed at producing more affordable EVs, according to Bloomberg.

The move comes as electric vehicle demand falls short of expectations and costs climb, pressures that have already forced rivals like GM and Honda to scale back their own investments.

The company stated that its Tennessee battery project is still moving forward, supported by a $9.63 billion loan from the U.S. Department of Energy, which also covers the Kentucky sites.

Still, the company faces pressure from tariffs and higher expenses, estimating $2.5 billion in costs tied to Trump-era levies. Ford has pledged to recover $1 billion through efficiency measures but expects to shoulder a remaining $1.5 billion in 2025.

On Stocktwits, retail sentiment for Ford was ‘neutral’ amid ‘low’ message volume.

Ford’s stock has risen 27.7% so far in 2025.

Editor’s note: This story was updated with Ford’s response about its Kentucky plant plans.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)