Advertisement|Remove ads.

Fossil Group Stock Rises To Highest Since March 2023 After Report Of India Unit Considering $400M IPO

Fossil Group, Inc.'s stock rose 41.5% to a two-and-a-half-year high on Wednesday, following a report that the India unit of the premium watch-maker was exploring a local initial public offering (IPO).

Fossil India Pvt. is in talks with bankers to raise about $300 million to $400 million by selling as much as 25% stake, Bloomberg reported, citing unnamed sources. The timing of the potential IPO is not known.

The report in India led to the U.S. parent company's stock recording its best performance since December 2024. It comes amid a string of multinational firms recently listing their India businesses on the national stock exchanges. IPOs from Hyundai Motor Co. in October 2024 and LG Electronics Inc. earlier this week were the biggest in the category.

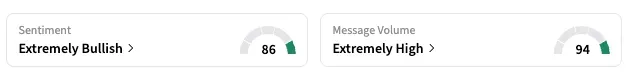

On Stocktwits, the 24-hour message volume for the FOSL ticker jumped 1,166% as the retail sentiment shifted to 'extremely bullish' as of early Thursday, from 'neutral' the previous day.

Known for its premium watches, Fossil Group also sells jewelry, handbags, and small leather goods. It manages its own portfolio of lifestyle accessories, including Fossil, Michele, and Skagen, along with licensed brands such as Armani Exchange, Diesel, Emporio Armani, Kate Spade New York, Michael Kors, and Tory Burch, according to its website.

Earlier this year, the group announced plans to close about 50 retail stores and transition select international markets to a distributor model, aiming to save approximately $100 million.

It reported $800 million in revenue and an $11 million net loss last year. The India unit is profitable.

With Wednesday’s rally, FOSL stock is now up 124.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: iRobot Stock’s 37% Surge Sends Retail Traders Into Frenzy: Is A Short Squeeze Coming?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)