Advertisement|Remove ads.

Freshpet Stock Slips On Oppenheimer Downgrade Due To Cautious Guidance: Retail Remains Downbeat

Shares of Freshpet (FRPT) fell nearly 2% on Tuesday after the pet foods maker received a downgrade from Oppenheimer following the company’s “disappointing guidance,” with retail sentiment staying downbeat.

Oppenheimer analyst Rupesh Parikh downgraded Freshpet to ‘Perform’ from ‘Outperform,’ The Fly reported.

For 2025, Freshpet said it expects revenue to be between $1.18 billion and $1.21 billion, below the consensus estimate of $1.22 billion.

While Freshpet has long-term growth drivers such as product innovation, household penetration, and global expansion, the company has near-term challenges, Investing.com reported, citing the firm.

The brokerage noted that investors need to wait for further stabilization before playing for a potential reacceleration trade, given the "more subdued" commentary from management and a slow start to the year, according to the report.

Additionally, it is harder to call a bottom in Freshpet shares even as Oppenheimer views the stock's risk/reward as balanced, added the report.

Oppenheimer considers Freshpet a long-term acquisition target, but warned about limited upside potential for its stock given the prevailing market conditions that have slowed down appetite for high-risk investments.

JPMorgan lowered the firm's price target to $102 from $154 with a ‘Neutral’ rating following its fourth-quarter report, The Fly reported. According to the firm, consumption trends and estimates for both Q1 and the next two years "might be slightly optimistic."

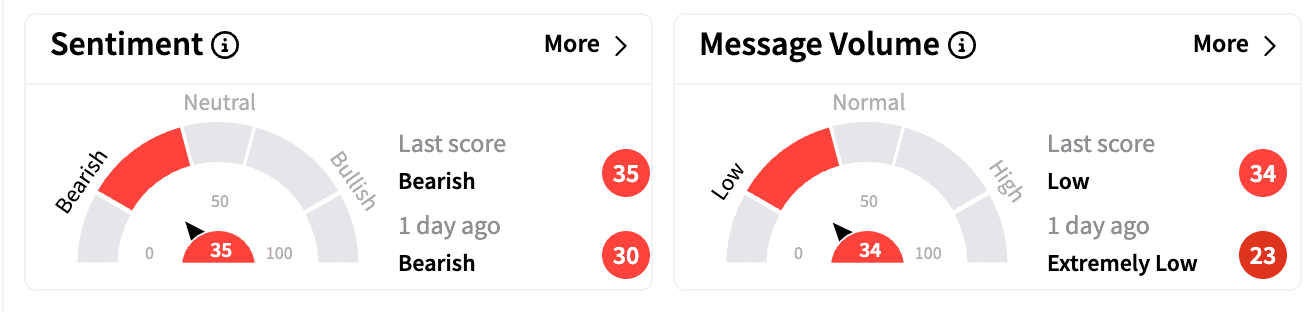

Sentiment on Stocktwits remained in the ‘bearish’ zone compared to a day ago. Message volume was at ‘low’ levels at the time of writing.

Bedminster, N.J.-based Freshpet, which makes ‘Joy Turkey’ and ‘Apple Bites Treats, ’ posted Q4 earnings per share (EPS) of $0.36, missing estimates of $0.41.

Its stock is down 43% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)