Advertisement|Remove ads.

Frontier Group Stock Slips After Forecasting Q2 Loss, Capacity Curtailments: Yet Retail’s Extremely Bullish

Frontier Airlines' parent, Frontier Group (ULCC), stock slipped 2.5% in extended trading on Thursday after the company forecasted a second-quarter loss and capacity curtailment due to weak demand.

The ultra-low-cost airline projected adjusted second-quarter loss in the range of $0.23 to $0.27 per share, while analysts expected it to report a profit of $0.04 per share, according to FinChat data.

Analysts fear customers would cut down on air travel if recession fears persist due to a tariff-driven trade war.

According to U.S. Transportation Security Administration data, annual growth in passenger traffic fell to 0.7% in March from 5% in January.

The company and its peers, such as Delta and Southwest Airlines, have pulled their annual forecasts due to the unpredictability surrounding demand.

“Economic uncertainty weighed heavily on demand, most notably in March, and it was met with aggressive pricing and promotions across the industry,” said Chief Financial Officer James Dempsey.

Frontier reported an adjusted loss of $0.19 per share for the first quarter, which was narrower than Wall Street’s expectations of a $0.21 per share loss.

The company’s total revenue per passenger was $116, 6% lower than the same period last year.

“We expect capacity to be down low single digits in the second quarter and a similar reduction in the second half of the year based on current conditions,” CEO Barry Biffle said.

Frontier expects to reduce costs by $300 million through capacity cuts.

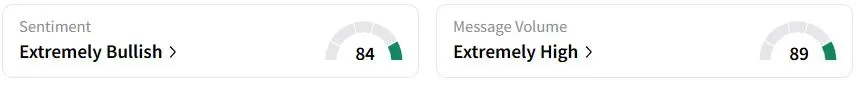

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (84/100) territory, while retail chatter was ‘extremely high.’

One retail trader noted that a few bad weeks in March likely ruined the company's quarter.

Frontier stock has fallen 56.6% year to date (YTD).

Also See: Block Stock Tumbles On 2025 Profit Cut, But Dorsey Eyes Q3 Rebound: Retail Eyes Scooping The Dip

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)