Advertisement|Remove ads.

Tesla Analysts Shrug Off Q4 Delivery Dip — Say AI, Robotaxi And Full Self-Driving Are The Real Bet

- William Blair said Q4 deliveries were “expected” and should have little impact on the stock.

- Stifel called the results neutral, while Truist said AI and full self-driving matter more than deliveries.

- RBC Capital cited the EV credit expiry for the miss and flagged potential support from China.

Tesla shares fell on Friday after the company reported fourth-quarter (Q4) deliveries broadly in line with Wall Street expectations, as analysts weighed slowing auto volumes against longer-term bets on AI and autonomy.

The stock fell 1.1% to $444.80 at the time of writing.

Tesla said it delivered 418,227 vehicles in Q4, below last year’s level and slightly under the 422,850 vehicles expected by analysts, according to a company-compiled estimate.

Deliveries Seen As Largely Neutral

According to TheFly, William Blair analyst Jed Dorsheimer said Tesla’s Q4 deliveries were “expected,” noting that the 16% sequential decline followed a record prior quarter and reflected the expiration of U.S. EV tax credits.

He said the outcome should have little influence on the stock, which he views as being valued “almost entirely” on Tesla’s transition toward real-world AI through robotaxi services and the Optimus humanoid robot. William Blair maintained a ‘Market Perform’ rating.

Stifel also described the results as roughly neutral, saying deliveries were slightly above its forecast but about 1% below consensus.

The firm attributed the sequential and year-on-year declines to the lapse of U.S. EV incentives and said the focus will now shift to margin details at Tesla’s earnings release scheduled for Jan. 26. Stifel has a ‘Buy’ rating and a $508 price target on the stock.

AI Focus Overshadows Auto Volumes

Truist analyst William Stein lowered his price target to $439 from $444 and reiterated a ‘Hold’ rating, saying investors should focus more on Tesla’s AI initiatives, particularly full self-driving. Truist described the stock’s initial bounce as “better than feared,” adding that energy storage deployments beat expectations.

RBC Capital said Tesla’s deliveries came in below the company-polled consensus, citing the U.S. EV credit expiry as a key factor. The firm maintained an ‘Outperform’ rating with a $500 price target and said weaker demand from Chinese competitors could support Tesla in that market.

Stabilization Versus Skepticism

Deepwater Management managing partner Gene Munster said Tesla delivered slightly above the “whisper number” and argued that, after adjusting for the pull-forward of demand ahead of the tax credit expiry, deliveries appear to be stabilizing. He said this stabilization allows investors to remain focused on autonomy and suggested Tesla may have gained U.S. EV market share in the December quarter for the first time in several years.

In contrast, Tesla researcher Troy Teslike warned in a post on X of a potentially larger decline in deliveries in 2026. He questioned whether Tesla can achieve scalable, driverless full self-driving with a vision-only approach and generate profits before automotive volumes fall further.

How Did Stocktwits Users React?

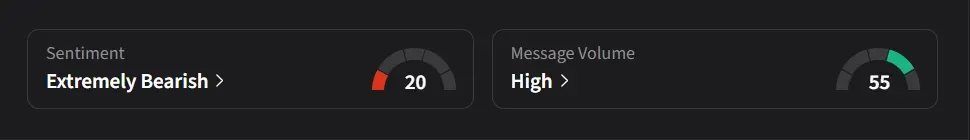

On Stocktwits, retail sentiment for Tesla was ‘extremely bearish’ amid ‘high’ message volume.

One user said Tesla could sell about 500,000 low-cost cars in India, but remains focused mainly on the U.S. and China.

Another user said they would not be surprised to see the stock continue to run through the rest of the session into the close.

Tesla’s stock has risen 10% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)