Advertisement|Remove ads.

Top Wall Street Loser Fulcrum Therapeutics Drags Retail Sentiment To Ground After Drug Trial Fails, Analysts Slash Ratings

Shares of Fulcrum Therapeutics, Inc. (FULC) plummeted nearly 70% on Thursday, making it the biggest loser across U.S. exchanges, after the company announced the failure of its drug candidate aimed at treating a rare muscle disorder .

The Phase 3 REACH trial for losmapimod, an experimental drug aimed at treating facioscapulohumeral muscular dystrophy (FSHD), did not meet its primary or secondary endpoints.

FSHD, a rare genetic disorder that causes muscle weakness and wasting, reportedly affects about four in 100,000 individuals.

Losmapimod was positioned to become the first approved therapy for this progressive muscle-wasting condition, but the trial’s failure marks a significant setback for Fulcrum and its ambitions.

The trial’s failure is a particularly harsh blow given Sanofi’s recent $80 million bet on losmapimod just four months ago. The licensing deal carried hopes that late-stage success could propel the p38 inhibitor into a first-of-its-kind treatment for FSHD.

Sanofi’s U.S.-listed shares were down 1.3% on the Nasdaq following the news.

With $273.8 million in cash and equivalents, Fulcrum plans to shift focus to its remaining pipeline, led by pociredir, a Phase 1-stage drug for sickle cell disease that aims to increase fetal hemoglobin expression.

However, the outlook remains bleak as analysts slashed their ratings and price targets on the stock.

Stifel downgraded Fulcrum to ‘Hold’ from ‘Buy’, cutting its price target to $3 from $22, citing the “logical” but “disappointing” decision to discontinue losmapimod development.

BofA dropped its rating to ‘Underperform’ from ‘Neutral’ and reduced its price target to $2 from $10.

Leerink downgraded the stock to ‘Market Perform’ from ‘Outperform’ with a price target of $4, down from $16, pointing to high stakes and a lack of approved therapies for FSHD.

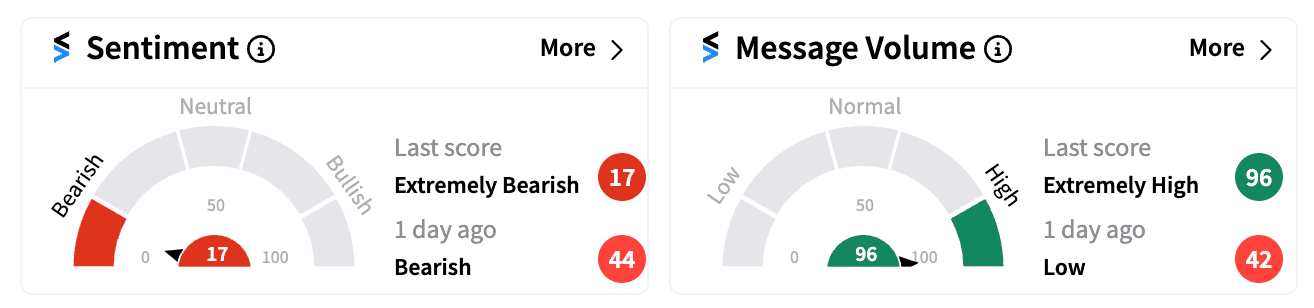

Retail sentiment on Stocktwits turned sharply negative, to ‘extremely bearish’ (17/100), accompanied by increased message volume.

One user lamented, “$FULC biggest risky play in a long time turned into my biggest loss in a long time. Sorry folks.”

Another bearish watcher predicted further declines, stating, “$FULC they have nothing else in the pipeline, going to 1.”

FULC stock has lost more than half of its value this year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/08/startup_funding1.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/07/logisitics345-2024-07-d688ea87ab99b45532771210d765b8d5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stellantis_ram_truck_OG_jpg_78d19a0ac9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)