Advertisement|Remove ads.

GameStop Shares Rise More, Hold Appeal Amid Tariffs-Induced Market Crash: Retail Investors Bullish

GameStop Corp (GME) is proving to be a haven in a market that is melting from President Donald Trump's trade war, thanks to a series of recent moves that have made the stock attractive again among retail investors.

Shares of the well-known “meme stock” rose 3.4% on Monday and gained another 1.7% in after-hours trading to $24.70. They gained 11.3% in the previous session.

That contrasts with the benchmark S&P 500 (SPX), which declined 6% and 0.2% in the last two sessions.

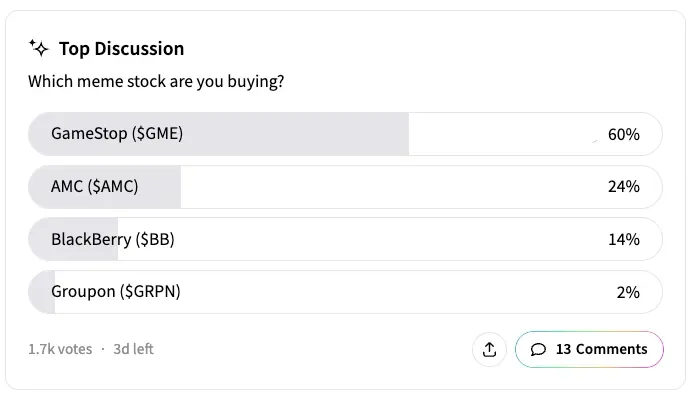

In a Stocktwits poll, 60% of about 1,700 respondents preferred GameStop as the stock to buy from a basket of popular meme stocks such as AMC Entertainment (AMC), Blackberry (BB), and Groupon (GRPN).

Confidence in GameStop comes, among other things, from company insiders buying shares. Last week, CEO Ryan Cohen bought 500,000 company shares worth $10.8 million.

The management buying shares in the company typically signals their confidence in the business.

GameStop is also pushing ahead with a significant Bitcoin play. The video games retailer is raising $1.3 billion through convertible notes to buy Bitcoin as a balance sheet asset.

The move has generated a mixed response — shares moved up and down widely the week before last — although it has raised interest among investors.

GameStop's unusual moves are keeping investors hooked, and Cohen's recent post was another in this category.

Cohen, a known Trump supporter, quipped about U.S. import tariffs on Friday, saying in an X post: "I can't wait for my $10,000 made in the USA iPhone."

GameStop has suffered too, indirectly. Soon after Trump’s tariff announcement, Nintendo said it would indefinitely halt U.S. preorders of the Nintendo Switch 2 due to a potential impact.

On Stocktwits, retail sentiment for the company held in the 'bullish' category with 'high’ message volume, as of late Monday.

Users posted saying that GME could be a hedge against the stock market crash.

GME shares are down 22.5% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)