Advertisement|Remove ads.

Gates Industrial Reports Better-Than-Expected Q4 Earnings: Retail’s Unswayed

Gates Industrial Corporation (GTES), a manufacturer of power transmission belts and fluid power products, drew retail attention on Thursday after reporting upbeat fourth-quarter earnings. Shares of the company surged over 5% at the opening bell.

Gates Industrial reported a 4% year-over-year (YoY) decline in net sales to $829.4 million compared to a Wall Street estimate of $827.43 million.

The decline was primarily due to lower volume. Core sales fell 2.6% YoY led by soft demand in Agriculture and Construction, partially mitigated by growth in Automotive segments.

Adjusted earnings per share (EPS) came in at $0.36 versus an analyst estimate of $0.33. However, net income fell to $36.6 million compared to $62.9 million led by a significant tax expense during the quarter.

CEO Ivo Jurek said the company’s balance sheet is strong, and capital deployment optionality continues to expand. “We are making investments in our business that we believe will generate significant dividends for our growth and profitability over the mid-term,” he said.

Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) was $180.8 million compared to $185.8 million in the prior-year quarter while adjusted EBITDA margin of 21.8% represented an expansion of 30 basis points over last year.

The company said that in the fourth quarter (Q4), Power Transmission net sales fell 2.4% to $520 million from a year earlier, while Power net sales decreased 6.4% to $309.4 million.

For 2025, the company expects adjusted Earnings Per Share of $1.36 to $1.52 compared to a Wall Street estimate of $1.51. Core sales growth is expected at -0.5% to 3.5% YoY.

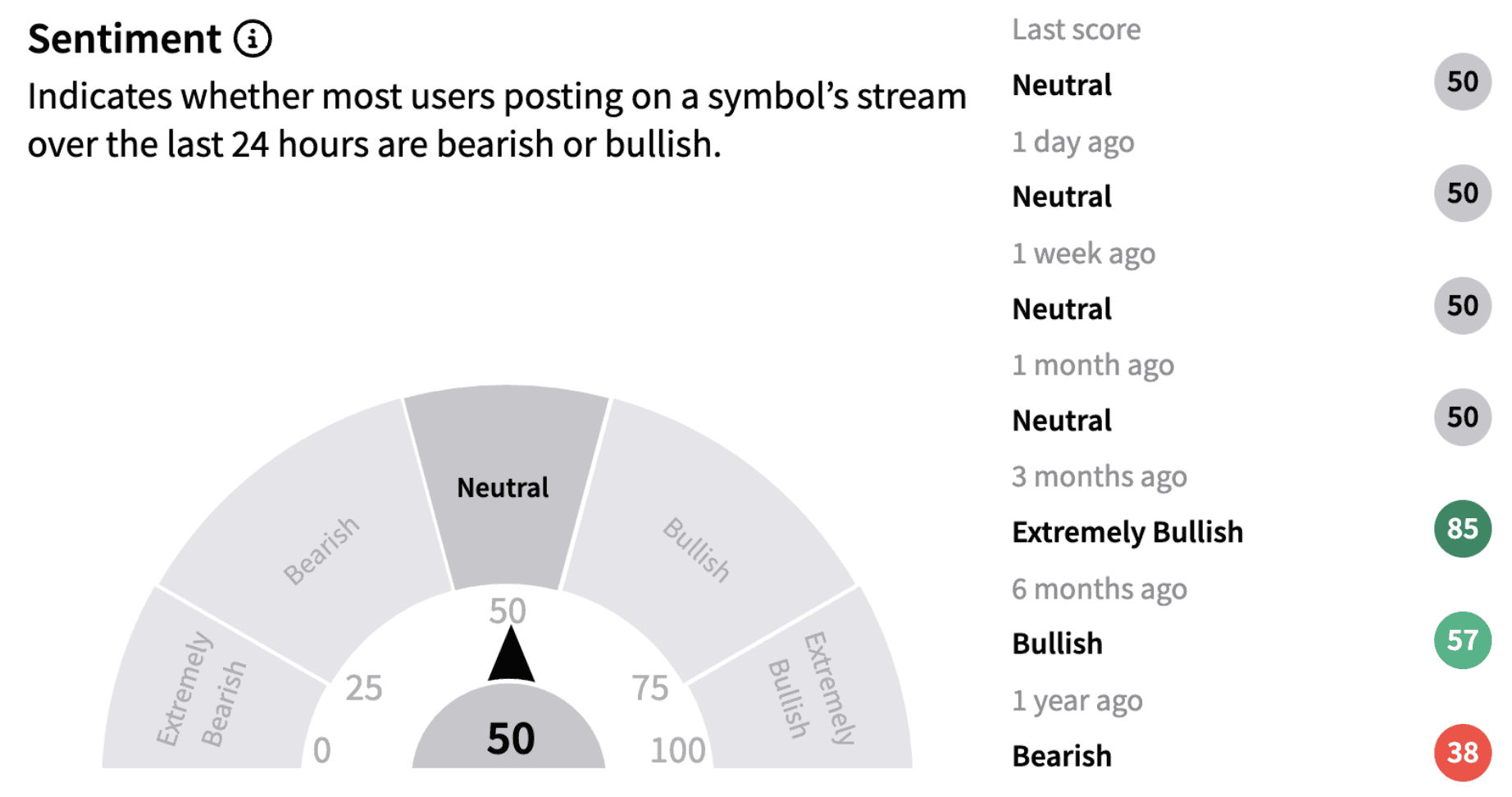

On Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory (50/100).

Recently, Citi analyst Andrew Kaplowitz lowered the firm's price target on Gates Industrial to $24 from $27 while keeping a ‘Buy’ rating on the shares.

Gates stock has gained nearly 2% in 2025 and is up over 57% over the past year.

Also See: Uber Stock Gets Slew Of Price Target Cuts From Analysts Post Q4 Earnings: Retail Shrugs It Off

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)