Advertisement|Remove ads.

Uber Stock Gets Slew Of Price Target Cuts From Analysts Post Q4 Earnings: Retail Shrugs It Off

Uber Technologies Inc (UBER) stock received a slew of price target cuts on Thursday after the company reported its fourth-quarter earnings on Wednesday.

Citi lowered its price target on Uber to $92 from $98 while keeping a ‘Buy’ rating on the shares.

According to TheFly, the firm believes autonomous vehicles remain the key debate. It noted that while it remains in the early days, the company’s size, scale, and operational experience make it a likely core partner to autonomous vehicles (AV) networks over time.

JPMorgan lowered its price target on the stock to $90 from $95 while keeping an ‘Overweight’ rating on the shares.

The brokerage noted that Uber's earnings results were mixed, with strong bookings growth ahead of expectations, but earnings before interest, tax, depreciation, and amortization (EBITDA) were more in line with consensus rather than the usual high-end beat.

JPMorgan also noted that it would buy the shares on the pullback but dropped the price target on a lower multiple driven by lower Mobility EBITDA margins.

On Wednesday, Uber reported a 20% year-over-year (YoY) rise in its fourth-quarter revenue to $11.96 billion compared to a Wall Street estimate of $11.78 billion.

The company’s Q4 net income rose 382% YoY to $6.88 billion. However, the figure includes a $6.4 billion benefit from a tax valuation release and a $556 million benefit (pre-tax) due to net unrealized gains related to the revaluation of Uber’s equity investments. Earnings per share (EPS) came in at $3.21 versus an estimated $0.48.

For the first quarter of 2025, Uber expects gross bookings of $42.0 billion to $43.5 billion, with the firm’s outlook assuming a roughly 5.5 percentage point currency headwind. This compares with an estimate of $43.51 billion.

JMP Securities kept a ‘Market Perform’ rating on the shares as it awaits more clarity on Uber's AV strategy and competition before becoming more optimistic about the stock.

The brokerage believes the company’s valuation could remain capped in the near term as the AV overhang limits the appreciation of shares.

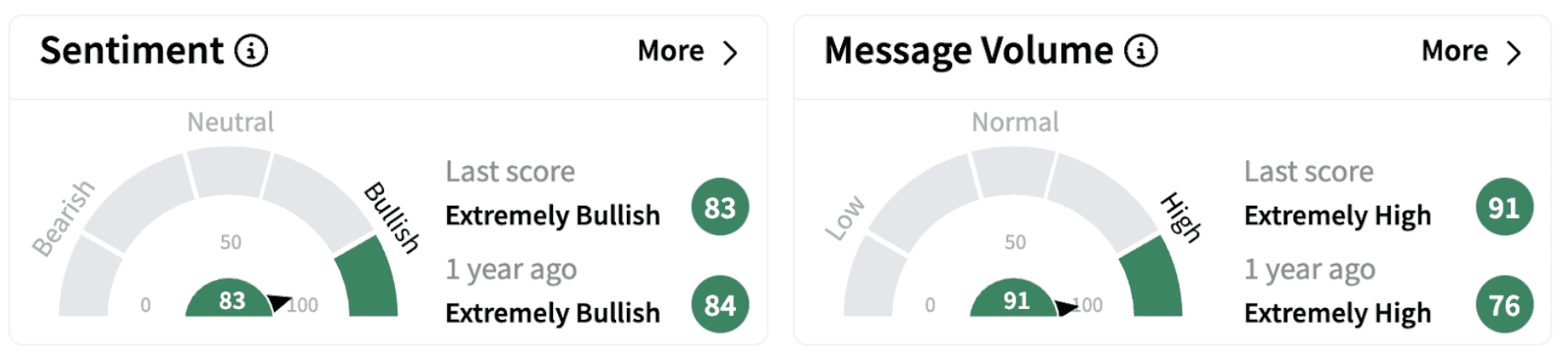

On Stocktwits, retail sentiment continued to trend in the ‘extremely bullish’ territory (83/100) accompanied by significant retail chatter.

Retail chatter on Stocktwits reflected optimism about the stock’s near-term prospects.

Piper Sandler lowered the firm's price target on Uber to $80 from $82 while keeping an ‘Overweight’ rating on the shares. Wells Fargo reduced its price target to $87 from $90 while maintaining an ‘Overweight’ rating.

Uber shares have gained over 2% in 2025 but are down over 8% over the past year.

Also See: Symbotic Stock Dives 17% Pre-Market After Q1 Earnings Miss: Retail Eyes Bottom Fishing Opportunity

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)