Advertisement|Remove ads.

Global Business Travel Group Stock Falls On DOJ’s Lawsuit To Block Acquisition Of CWT Holdings

Shares of Global Business Travel Group Inc. (Amex GBT) fell over 3% on Friday after the Justice Department (DOJ) filed a civil antitrust lawsuit to stop the firm, the largest business travel management company in the world, from acquiring its rival, CWT Holdings LLC (CWT).

CWT is the third-largest business travel management company in the world.

In March 2024, Amex GBT announced its intent to acquire CWT in a $570 million deal that was to be funded by a combination of stock and cash and was expected to close in the second half of 2024.

DOJ’s lawsuit alleges that the proposed transaction would impact competition for business travel management services to U.S. global and multinational businesses. Notably, this is Amex GBT’s fifth acquisition of another travel management company since 2018.

Acting Assistant Attorney General Doha Mekki said the acquisition is the latest in a series of deals done by Amex GBT that will further consolidate an already consolidated market.

"American businesses will face the consequences, seeing higher prices, less innovation, and fewer choices,” Mekki said.

The DOJ explained that both firms compete fiercely to provide travel management services for large businesses and those with complex travel needs. Amex GBT had recently lost several significant bid opportunities for large business customers to CWT after the latter began pursuing new and innovative strategies to improve service and reduce prices.

“If Amex GBT is permitted to acquire CWT, this intense competition would be lost, risking higher prices, less innovation, and fewer choices,” the DOJ said.

Although Amex GBT operates as a separate company, it is noteworthy that American Express holds a minority interest in the firm.

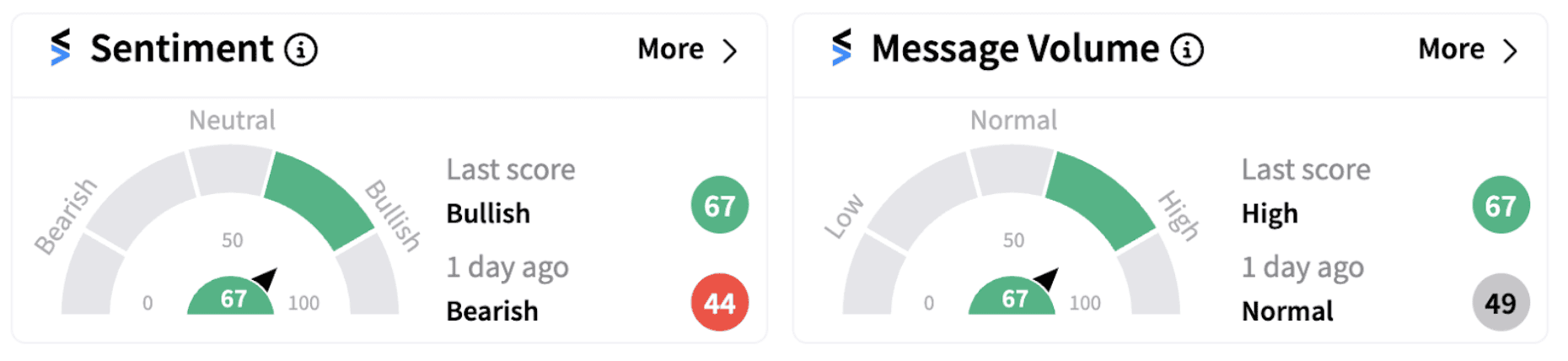

Interestingly, American Express shares traded down over 2% on Friday afternoon following the lawsuit announcement but retail sentiment surrounding the stock was trending in the ‘bullish’ territory (67/100) compared to ‘bearish’ a day ago. The move was accompanied by ‘high’ message volume.

Earlier this week, Truist initiated coverage of American Express with a ‘Buy’ rating and a $350 price target.

American Express shares have risen over 59% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)