Advertisement|Remove ads.

GE Aerospace Retail Chatter Jumps Amid Soaring Q2 Revenue, Guidance Hike

GE Aerospace (GE) reported a better-than-expected second-quarter (Q2) performance on Thursday, prompting the company to raise its financial targets for both 2025 and 2028.

Revenue, earnings, and cash flow all surged, driven by strong demand in its commercial services division and a significant increase in order volume.

Following the earnings, GE Aerospace stock traded over 2% higher in Thursday’s premarket.

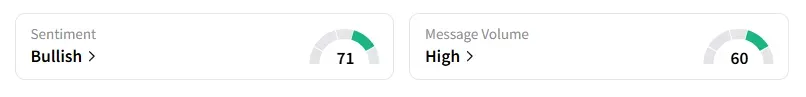

On Stocktwits, retail sentiment toward GE Aerospace improved to ‘bullish’(71/100) from ‘neutral’ territory the previous day. Similarly, message volume levels jumped to ‘high’(60/100) from ‘normal’ in the last 24 hours.

GE Aerospace's total revenue grew 21% year-on-year (YoY) to $11 billion in the second quarter, exceeding the analysts' consensus estimate of $9.55 billion, as per Fiscal AI data.

The adjusted earnings per share (EPS) of $1.66 also surpassed the consensus estimate of $1.4, a 38% increase YoY. The Commercial Engines & Services (CES) unit revenue jumped 30% YoY to $8 billion.

The operating profit for Q2 gained 23% YoY to $2.3 billion, and the operating margin contracted 10 basis points to 23%.

The free cash flow of $2.1 billion in the quarter increased 92% YoY. GE Aerospace held $10.8 billion in cash and equivalents as of June 30.

The company raised its 2025 revenue growth outlook to mid-teens from low-double-digits and adjusted EPS to between $5.60 and $5.80 from $5.10 to $5.45.

GE also increased its 2028 revenue growth outlook to a double-digit compound annual growth rate (CAGR) and expects adjusted EPS of approximately $8.40. The company stated that it will increase capital returns to shareholders from 2024 to 2026 by 20%.

Backed by a record-setting engine deal and improved supplier performance, the company now projects operating profit to reach $11.5 billion and free cash flow to hit $8.5 billion by 2028.

“We are raising our 2025 guidance and 2028 outlook, with our operating performance and robust commercial services outlook underpinning our higher revenue, earnings, and cash growth expectations,” said Chairman and CEO H. Lawrence Culp, Jr.

GE Aerospace stock has gained over 59% year-to-date and over 69% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)