Advertisement|Remove ads.

GlobalFoundries Stock Gains As Morgan Stanley Expresses Optimism Over Long-Term Growth Prospects Post Q4 Results: Retail Turns Extremely Bullish

Shares of GlobalFoundries Inc. (GFS) rose by more than 3% in morning trade on Wednesday as analysts at Morgan Stanley expressed optimism about the company’s long-term growth prospects.

According to TheFly, Morgan Stanley analysts hiked their price target to $42 from $40, reiterating their ‘Equal Weight’ rating on the stock. The GlobalFoundries stock was trading near the $42 level at the time of writing.

While the brokerage noted that GlobalFoundries' first-quarter (Q1) guidance was below expectations, it observed that the company's long-term growth outlook remains constructive.

GlobalFoundries posted earnings per share (EPS) of $0.46 during the fourth-quarter (Q4), ahead of Wall Street’s estimates of $0.45, according to Stocktwits data.

It guided for revenue between $1.55 billion to $1.60 billion, below a consensus estimate of $1.66 billion for the first quarter, according to FinChat data.

The company’s data center and automotive segments drove its topline during the quarter, which grew 18% and 30% year-on-year, respectively.

Analysts at Baird also underscored that GFS remains well-positioned for a rebound after a tough first quarter.

The brokerage has an ‘Outperform’ rating on the GFS stock, with a price target of $50. This implies an upside of over 20% from current levels.

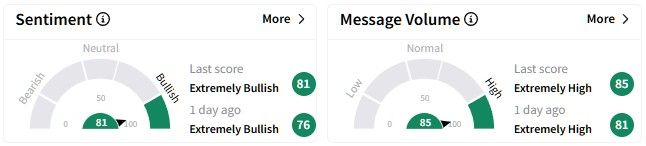

Retail sentiment on Stocktwits around the GFS stock was in the ‘extremely bullish’ (81/100) territory, while message volume was at the ‘extremely high’ levels.

GlobalFoundries’ stock declined nearly 4.6% over the past six months. However, its one-year performance is worse, with a fall of over 26%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_logal_paul_OG_jpg_3c5ff1734b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corsair_gaming_jpg_f2eebff8d4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)