Advertisement|Remove ads.

Corning Stock Boosts Retail Bullishness As Wall Street Analysts Raise Price Targets Post Q3 Earnings

Shares of Corning, Inc. ($GLW) rose marginally pre-market Wednesday after settling over 4% higher in the previous session on the back of upbeat third-quarter results.

Although the company on Tuesday reported a net loss of $117 million, or $0.14 per share, it beat expectations on adjusted metrics.

Revenue increased by 7% to $3.39 billion, while core sales, adjusted for one-time items, rose 8% to $3.73 billion, slightly exceeding analyst forecasts.

Adjusted earnings per share came in at $0.54, narrowly beating consensus estimates.

Corning also issued a stronger-than-expected Q4 outlook, anticipating EPS between $0.53 and $0.57 on revenue of approximately $3.75 billion, both above Wall Street’s predictions.

CFO Ed Schlesinger highlighted significant growth in Optical Communications, which saw 36% year-over-year sales growth, fueled by high demand for Corning’s new optical connectivity products for generative AI.

Additionally, Corning’s Display Technologies segment implemented price hikes and aims to achieve net income of $900 million to $950 million in 2025 with a net income margin target of 25%.

Following the earnings, at least four Wall Street analysts increased their price targets on Corning.

JPMorgan raised its target from $55 to $60, while retaining an ‘Overweight’ rating on the stock, noting Corning’s strength in Optical and Display segments.

Deutsche Bank upped its target from $49 to $54, while keeping a ‘buy’ rating, forecasting mid-teens core earnings growth over the next three years, supported by secular and cyclical growth drivers across key markets.

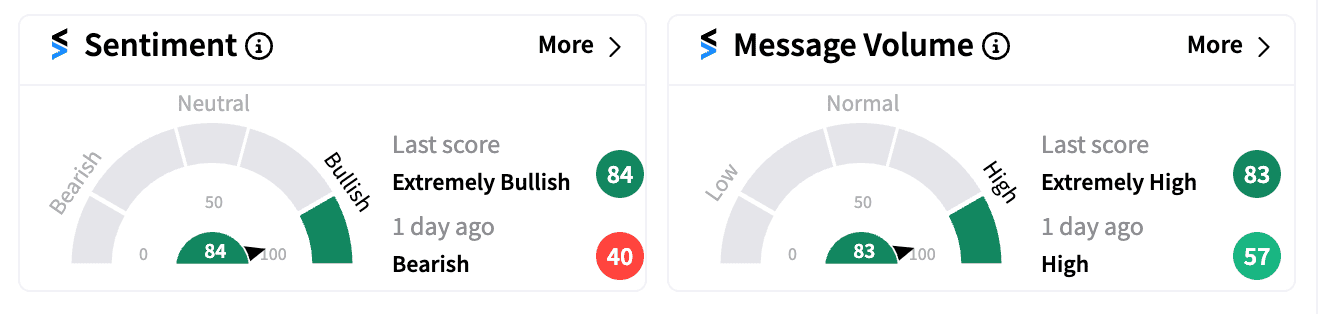

On Stocktwits, retail sentiment turned ‘extremely bullish’ (84/100) with message volume jumping over 260% in the previous session alone.

Corning recently secured a multiyear, $1 billion supply agreement with AT&T to support its fiber network expansion, further bolstering investor optimism.

Year-to-date, GLW stock is up more than 60%, significantly outperforming the S&P 500 and Nasdaq.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michellebowman_resized_jpg_392a174dc6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218489628_jpg_6d90e850fd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Western_digital_logo_2_resized_ec96a6ef9a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)