Advertisement|Remove ads.

AMD Slides 8% After Record AI-Driven Q3 Revenue Fails To Impress Wall Street, But Retail Sees Dip As Buy Signal

Advanced Micro Devices, Inc. ($AMD) shares tumbled over 8% in premarket trading on Wednesday following the chipmaker’s quarterly results.

Q3 Scorecard

Santa Clara, California-based AMD reported third-quarter non-GAAP earnings per share (EPS) of $0.92, in line with the consensus estimate. The bottom-line result was up 31% year-over-year (YoY) and 33% sequentially.

Revenue grew 18% YoY and 17% sequentially to $6.82 billion versus the consensus of $6.71 billion and the guidance of $6.7 billion, plus or minus $300 million.

“We delivered strong third quarter financial results with record revenue led by higher sales of EPYC and Instinct data center products and robust demand for our Ryzen PC processors,” said AMD Chair and CEO Dr. Lisa Su.

Data Center revenue, which comprises contributions from artificial intelligence chip sales, rose to a record $1.9 billion. The segment clocked 122% YoY growth and 25% sequential growth.

Su said on the earnings call that AMD’s AI accelerator MI300X adoption expanded with cloud, OEM and AI customers, Motley Fool reported. Data Center GPU revenue guidance for 2024 was raised from $4.5 billion to over $5 billion.

AMD defied the PC market downturn during the quarter as Client Segment revenue rose 29% YoY and 26% sequentially to $1.9 billion.

On the other hand, Gaming and Embedded segment revenue fell 69% and 25% YoY, respectively, to $462 million and $927 million.

Non-GAAP gross margin expanded three percentage points YoY and one point sequentially to 54%.

The Outlook

Looking ahead, CFO Jean Hu said, "We are on-track to deliver record annual revenue for 2024 based on significant growth in our Data Center and Client segments.”

For the fourth quarter, AMD guided to revenue of $7.5 billion, plus or minus $300 million, compared to Wall Street’s average forecasts of $7.54 billion. Non-GAAP gross margin will likely be at 54%, the company said.

Wall Street analyst reaction was not that positive. Barclays analyst Tom O’Malley reduced the price target for the stock from $180 to $170 while maintaining an ‘Overweight’ rating, according to the Fly. He sees the stock a “bit stuck for now,” given no distinct guidance for the out-year and AMD’s growth moderating.

AMD's Stock

AMD shares have added roughly 13% for the year-to-date period, with the gains paling before 23%+ gain for the iShares Semiconductor ETF ($SOXX).

In premarket trading, as of 6:36 am ET, AMD shares fell 8.36% to $152.35.

Retail Upbeat

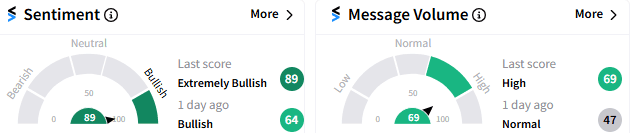

The retail crowd is not ready to throw in the towel yet. The stock was the sixth most-trending on Stocktwits, with sentiment in ‘extremely bullish’ levels (89/100) and ‘high’ message volume.

Some watchers expressed willingness to buy the dip, being convinced of the “long story.”

Some harbored hopes that the stock would turn the corner following the post-earnings dip.

Read Next: TMTG, CoreCivic, Humana Stocks Poised For Gains With Trump Victory: Retail Sentiment Mixed

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)