Advertisement|Remove ads.

GoPro Shares Jump After CEO Buys $2M Of Stock: Retail Remains Skeptical Amid Declining Business

- GoPro CEO Nicholas Woodman purchased $2 million worth of shares, according to an announcement on Thursday.

- The stock gained 4.6% in the after-market session.

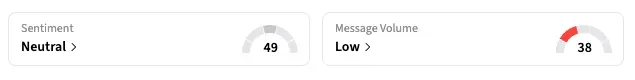

- Stocktwits sentiment for GPRO was “neutral,” reflecting the overhang from the company’s weak quarterly report last week.

GoPro, Inc.’s shares gained 4.6% in the after-hours session on Thursday after the company disclosed a stake by its CEO, Nicholas Woodman.

Through a trust, Woodman acquired $2 million worth of GoPro class A shares and said the investment reflects his “excitement for GoPro's diversified product pipeline in 2026 and beyond.”

Bullish Signal?

“We're pursuing a number of meaningful TAM-expanding opportunities in both hardware and software that will excite our customers and investors alike,” said. TAM, or target addressable market, refers to the total potential revenue opportunity for a product or service.

The company statement did not have details of the new initiatives, but Woodman’s reference was likely to the upcoming Hero14 camera and the company’s previously announced plan to license GoPro’s huge repository of videos for AI model training.

In a note earlier this month, Morgan Stanley analysts said they were encouraged by these initiatives and see a promising setup for GoPro heading into 2026. However, they cautioned that “consistent execution” remains a key challenge for the action camera company.

The investment firm raised its price target on GPRO to $1.30 from $0.80, while maintaining its ‘Underweight’ rating. The target is 14% lower than the stock’s latest close.

Investors, Analysts Skeptical

Broadly, investors remain skeptical of GoPro, especially after its recent quarterly report showed sharp declines across several key metrics.

Total revenue declined 37% to $163 million in the third quarter, with a sharper 41% drop in retail sales, and the net loss more than doubled to $21.3 million. The stock shed 10% last Friday, following the report.

“We expect to return to revenue growth and profitability beginning Q4 2025 and in 2026," Woodman said at the time.

On Stocktwits, the retail sentiment for GPRO was ‘neutral’ as of early Friday, unchanged from the previous day. Users were unsure what to make of the CEO's purchase.

“$GPRO wow is this a first ever since IPO where Nikki Woodman invested his own money,” said one user.

So far this year, GoPro shares have gained 38.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)